Social Media, Analyst Behavior and Market Efficiency

Alpha Architect

APRIL 26, 2024

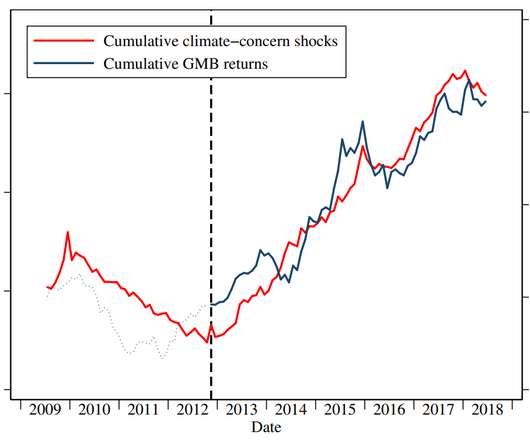

Hibbert, Kang, Kumar and Mishra provided us with yet another explanation: social media is providing analysts with information that reduces their forecasting errors. Please read the Alpha Architect disclosures at your convenience. The result has been an increase in market efficiency, leading to a reduction in the PEAD anomaly.

Let's personalize your content