Specialist accounting for Not For Profit organisations

Accounting for Good

APRIL 10, 2024

NFPs require specialist accounting services with a firm focusing only on the NFP sector. Accounting For Good is that firm. Contact us today for | AFG

Accounting Related Topics

Accounting Related Topics

Accounting for Good

APRIL 10, 2024

NFPs require specialist accounting services with a firm focusing only on the NFP sector. Accounting For Good is that firm. Contact us today for | AFG

Nerd's Eye View

NOVEMBER 9, 2022

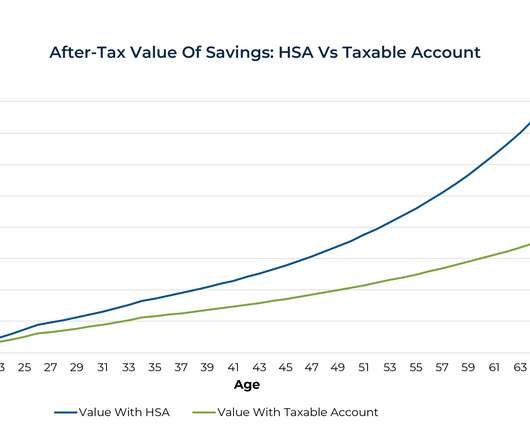

Health Savings Accounts (HSAs) are one of the most popular savings vehicles because of their triple-tax advantage: account owners can take an above-the-line tax deduction for eligible contributions, growth in the account is tax-deferred, and withdrawals are tax-free if they are used for qualified healthcare expenses.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Advisor Perspectives

DECEMBER 7, 2023

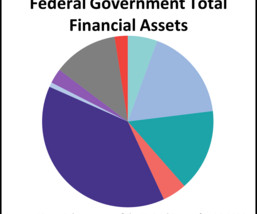

Without recourse to your text, your notes, or a Google search, what line item is the largest asset in Uncle Sam's financial accounts? Official Reserve Assets B) Total Mortgages C) Taxes Receivable D) Student Loans

AdvicePay

FEBRUARY 14, 2024

Are you aware that you have the capability to streamline billing on held-away accounts using AdvicePay and Pontera? Pontera empowers you with the tools to efficiently manage held-away accounts, while AdvicePay offers a comprehensive billing solution designed specifically to invoice clients for your advisory services.

Speaker: Nancy Wu, Head of Sales and Customer Success at SkyStem

Field of Study: Accounting. Let’s rediscover the power of reconciling the balance sheet, the best way to approach the work, and the pitfalls to avoid when preparing or examining reconciliations. 1 CPE credit will be provided for qualifying participants. Recommended CPE: 1 CPE. Program Cost: $0. Program Knowledge Level: Overview.

Accounting for Good

FEBRUARY 19, 2024

Getting onboard with Accounting For Good improves your day to day processes and ensures high-performance support. Contact Us Today | AFG

Wealth Management

SEPTEMBER 21, 2023

That gives the firm’s RIA custody clients free access to performance reporting, fee billing, portfolio rebalancing, a client portal and portfolio accounting software.

Advertisement

Digital transformation in account opening is the integration of streamlined processes to enhance the customer journey. Additionally, digital transformation reduces the amount of paperwork and manual labor involved in the account opening process.

Speaker: Wayne Spivak, President and CFO of SBA * Consulting Ltd., Industry Writer, Public Speaker

In this webinar, Wayne Spivak will share techniques applicable to not only spend management and GAP analyses, but a wide range of accounting topics, to show you how to go from your company’s current state to the state of the future your company wants and needs. June 6th, 2023 at 9:30 am PDT, 12:30 pm EDT, 5:30 pm BST

Advertisement

Technology is rapidly changing the way accountants perform and manage month-end activities. Spreadsheets, email, and shared drives no longer have to slow us down. Join us as we present a "sneak peek" recorded demo of SkyStem's month-end close solution – ART.

Speaker: Rita Keller - President of Keller Advisors, LLC

You've worked diligently and have built a glowing reputation grounded in your excellent skills in tax, accounting, and auditing. You're known as the “go-to” person when a client is faced with tax and financial decisions. You have a very successful firm -- but that’s not enough.

Let's personalize your content