Monday links: asset allocation magic

Abnormal Returns

OCTOBER 30, 2023

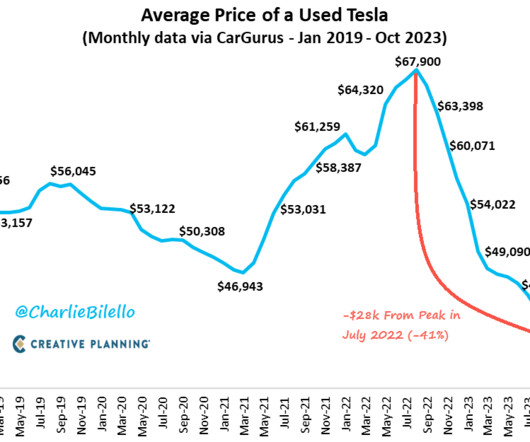

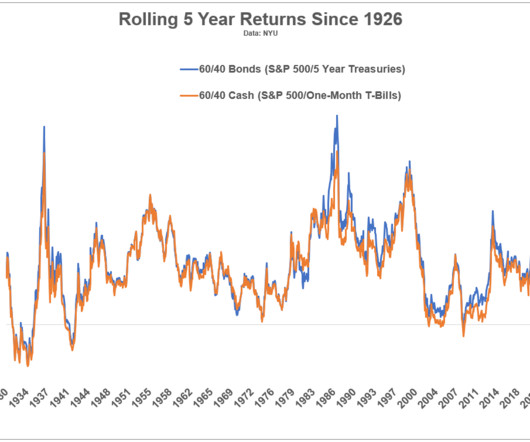

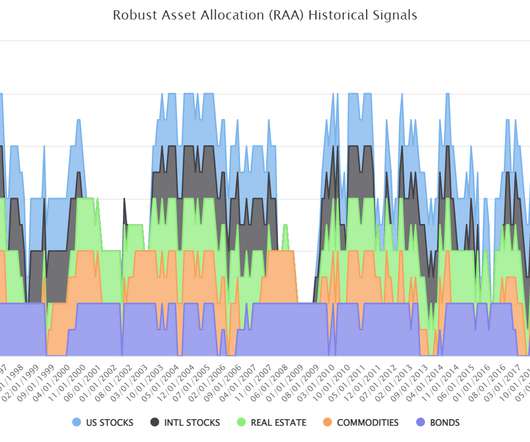

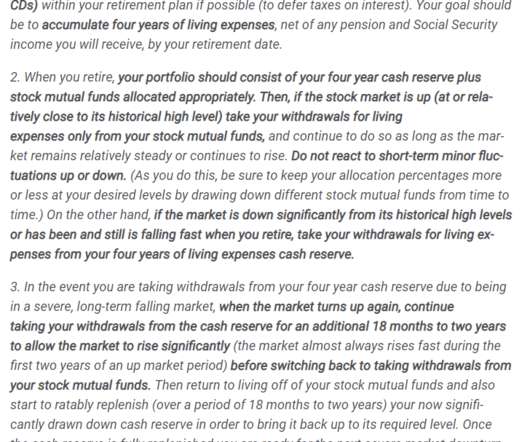

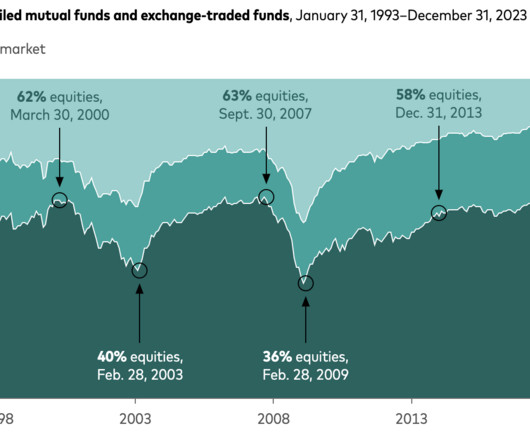

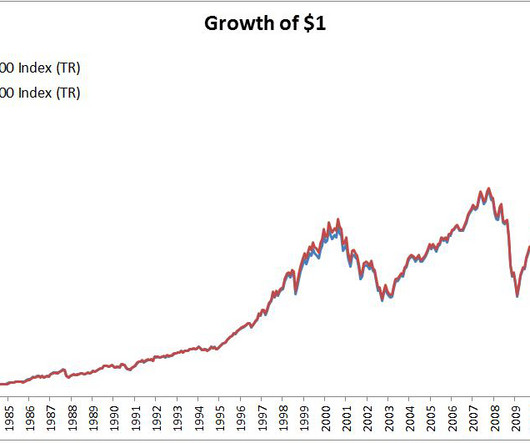

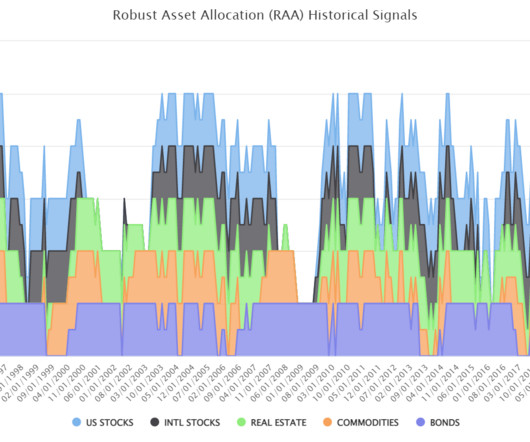

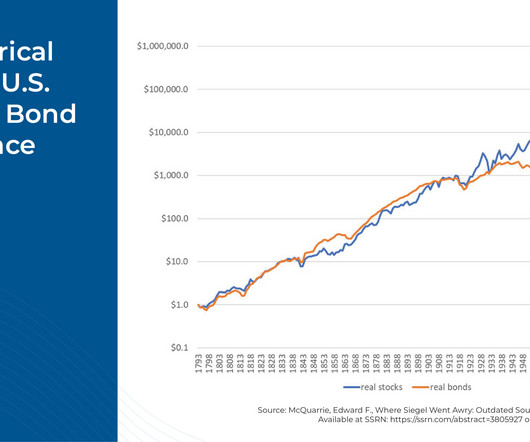

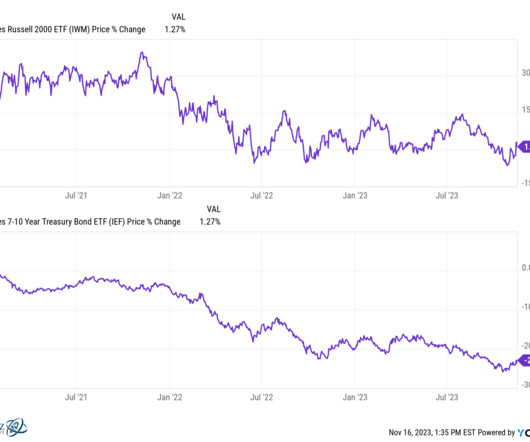

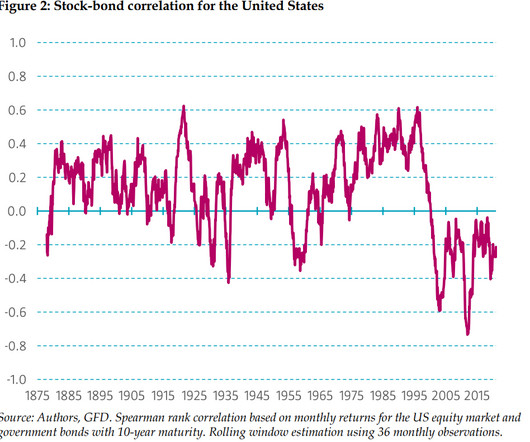

Strategy There's nothing magic about asset allocation. obliviousinvestor.com) Do stocks really become less risky over the long run? morningstar.com) Companies Google ($GOOGL) is investing $2 billion in AI player Anthropic. axios.com) Pharmaceutical companies are getting out to the consumer product business.

Let's personalize your content