Why Hasn’t the California Globe Retracted Its Story?

The Big Picture

JULY 7, 2024

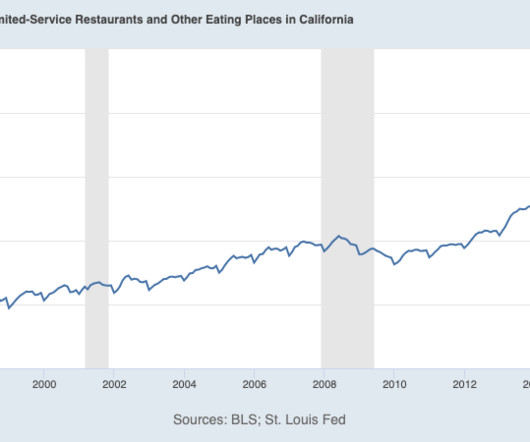

@TBPInvictus here If you’re tired of California-minimum-wage-and-its-impact-on-limited-service-restaurant-employment stories, I understand. Leave this page immediately. I’m tired of it, too, but some stories are so factually challenged that they demand a response. So, allow me to address a hot mess of a story that appeared recently in the California Globe.

Let's personalize your content