At the Money: How to Pay Less Capital Gains Taxes

The Big Picture

JANUARY 24, 2024

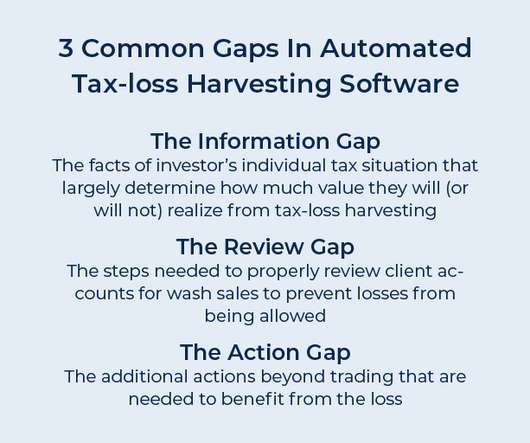

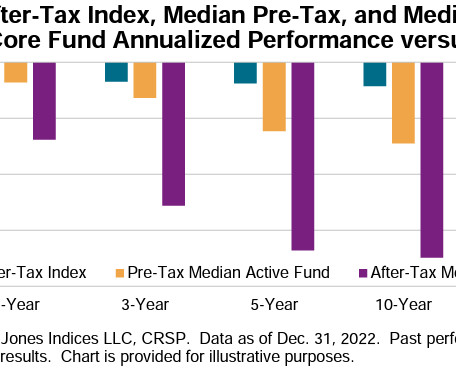

At the Money: How to Pay Less Capital Gains Taxes (January 24, 2024) We’re coming up on tax season, after a banner year for stocks. Successful investors could be looking at a big tax bill from the US government. On this episode of At the Money, we look at direct indexing as a way to manage capital gains taxes.

Let's personalize your content