Adviser links: exciting plans

Abnormal Returns

SEPTEMBER 18, 2023

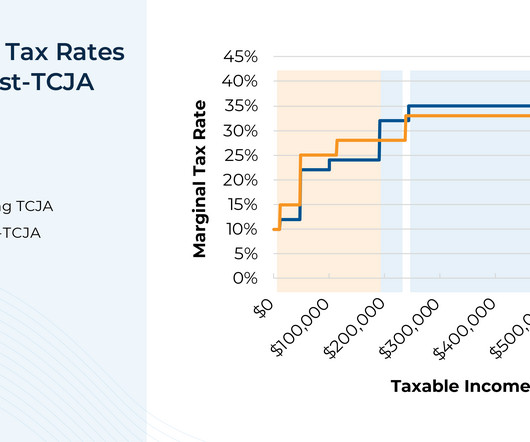

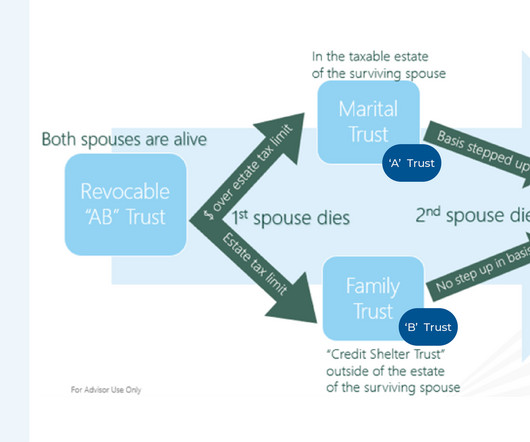

(citywire.com) Creative Planning is getting creative to retain former United Capital advisers. theirrelevantinvestor.com) Taxes Why clients need to start planning now for the coming dip in the estate tax exemption. riaintel.com) Selling a service, like financial planning, is different than selling a product.

Let's personalize your content