The Holy Grail of Portfolio Management

A Wealth of Common Sense

JANUARY 16, 2024

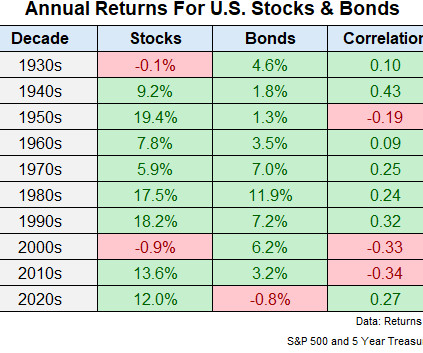

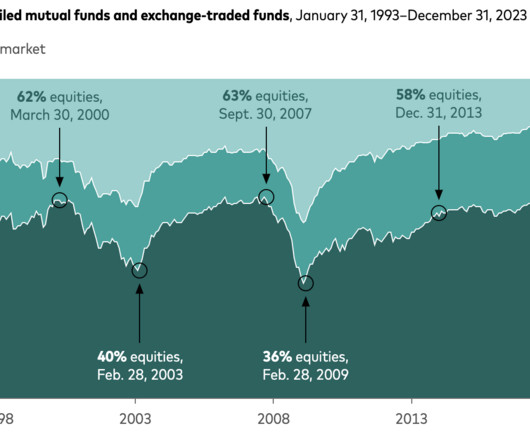

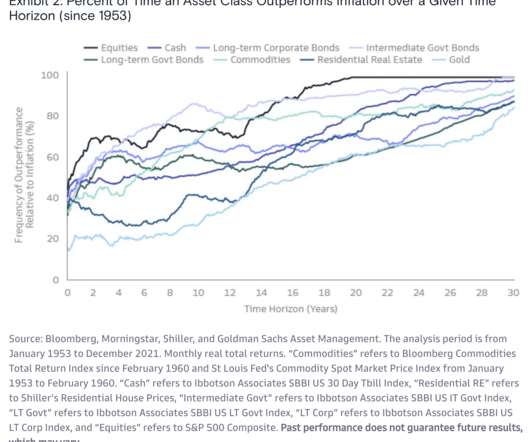

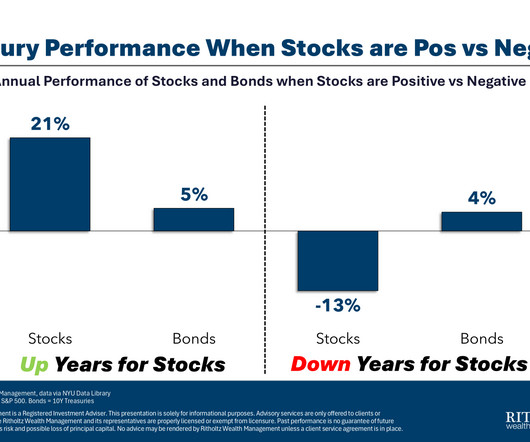

Diversification is one of the first building block portfolio management concepts I ever learned in my first job in the investment industry. Our firm would create a Harry Markowitz efficient frontier chart for every client portfolio.

Let's personalize your content