Taxpayer Granted Time to Make Alternate Valuation Election

Wealth Management

JUNE 18, 2025

IRS allows estate to make late alternate valuation date election due to reliance on tax professional.

This site uses cookies to improve your experience. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country, we will assume you are from the United States. Select your Cookie Settings or view our Privacy Policy and Terms of Use.

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Used for the proper function of the website

Used for monitoring website traffic and interactions

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Valuation Related Topics

Valuation Related Topics

Wealth Management

JUNE 18, 2025

IRS allows estate to make late alternate valuation date election due to reliance on tax professional.

The Big Picture

OCTOBER 9, 2024

ATM: Valuation is an exercise in faith with Aswath Damodaran. Full transcript below. ~~~ About this week’s guest: Professor Aswath Damodaran of NYU Stern School of Business is known as the Dean of Valuation. . ~~~ About this week’s guest: Professor Aswath Damodaran of NYU Stern School of Business is known as the Dean of Valuation.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Protect What Matters: Rethinking Finance Ops In A Digital World

Your Accounting Expertise Will Only Get You So Far: What Really Matters

The Big Picture

APRIL 8, 2023

A nine-time “Professor of the Year” winner at NYU, Damodaran teaches classes in corporate finance and valuation to MBA students. He has also written several books on corporate finance and equity valuation and has published widely in journals. Damdoran loves “untangling the puzzles of corporate finance and valuation.”

Wealth Management

JANUARY 24, 2023

What's driving RIA valuations? These factors are what smart buyers look for, and smart sellers keep in mind at all times, says Dynasty's CEO.

Wealth Management

MAY 8, 2024

A recent New York Times article suggested that Blackstone's non-traded REIT is inflating its property valuations. But real estate industry insiders say they are not worried.

Wealth Management

APRIL 9, 2025

Court of Appeals for the Second Circuit upholds QTIP trust valuation for estate tax, rejecting deduction for settlement payment to widows estate. In Kalikow v. Commissioner, the U.S.

Financial Symmetry

NOVEMBER 14, 2024

Current valuations have been a common basis for these pessimistic views. The difficulty of predicting the absolute level of … Continued The post What Today’s Valuations Are Telling Investors appeared first on Financial Symmetry, Inc. stocks over the next decade.

Nerd's Eye View

MARCH 6, 2024

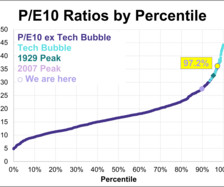

The Shilller Cyclically Adjusted Price-to-Earnings (CAPE 10) Ratio is one example that takes into account current market valuations versus company earnings, generally predicting that the higher the valuation at the beginning of a period the lower the expected return for that period.

Wealth Management

JANUARY 21, 2025

Analyzing the underpinnings of the U.S. Supreme Courts decision.

Nerd's Eye View

DECEMBER 27, 2024

Enjoy the current installment of "Weekend Reading For Financial Planners" - this week's edition kicks off with the news that according to a recent study by DeVoe & Company, only 42% of RIAs surveyed have written succession plans and either have begun to implement them or have already done so.

Wealth Management

FEBRUARY 28, 2024

Fund managers in this red-hot asset class are often valuing their loans more generously than others do. Regulators are starting to worry.

The Big Picture

JUNE 26, 2025

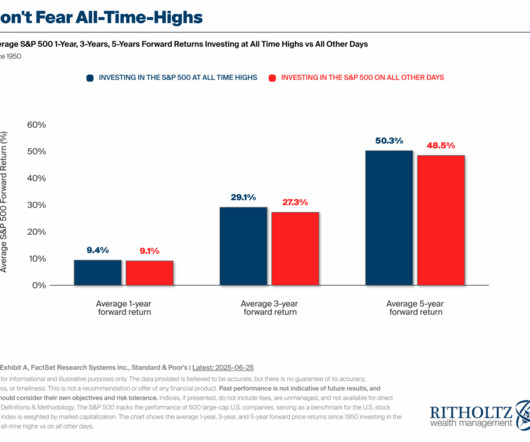

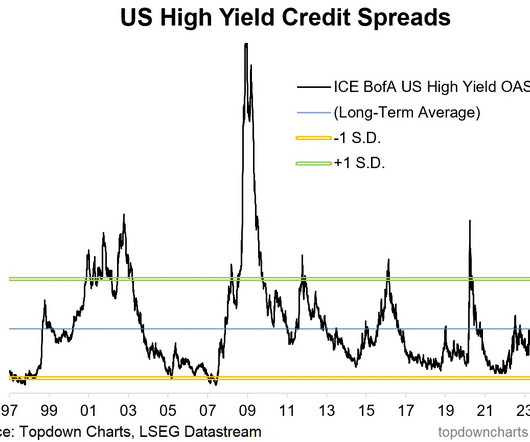

The usual suspects have already proffered their litany of horrors – valuations are too high, gains are too narrow, we havbe market concentrated and a toppy feel, to say nothing about all of the new geopolitical risks that continue to accumulate in tariffs war and oil prices.

Wealth Management

OCTOBER 8, 2024

Proceeds from minority raise will fund growth for Dynasty.

Wealth Management

APRIL 22, 2025

The fundraising round was led by GIC, Singapores sovereign wealth fund, to fuel product launches and executive hires, and values Altruist at $1.9

Advisor Perspectives

JULY 2, 2025

Our monthly market valuation updates have long had the same conclusion: US stock indexes are significantly overvalued, which suggests cautious expectations for investment returns. This analysis focuses on the P/E10 ratio, key indicator of market valuation, and its correlation with inflation and the 10-year Treasury yield.

Alpha Architect

JUNE 23, 2025

Are Discount Rates More Important than Future Earnings for Stock Valuation? This challenges many common asset pricing models and changes how investors should think about value, growth, and long-term return forecasting. was originally published at Alpha Architect. Please read the Alpha Architect disclosures at your convenience.

Abnormal Returns

JULY 1, 2025

larryswedroe.substack.com) When PE managers cut company valuations, look out for more down the road. (economist.com) Private equity A look at the fundamentals of private equity-owned firms. mailchi.mp) Why manager selection matters so much for alternatives. mebfaber.com) Why you may need a standalone REIT factor model.

Wealth Management

JUNE 4, 2025

Key steps for executors handling art and tangible property in estates, from initial inventory to valuation and disposition strategies.

Advisor Perspectives

JUNE 3, 2025

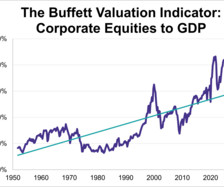

With the Q1 GDP second estimate and the May close data, we now have an updated look at the popular "Buffett Indicator" -- the ratio of corporate equities to GDP. The current reading is 207.8%, down slightly from the previous quarter.

Advisor Perspectives

JULY 1, 2025

Here is a summary of the four market valuation indicators we update on a monthly basis.

Wealth Management

MAY 14, 2024

Private equity money continues to fund inorganic growth for its chosen firms, and with more buyers comes more competition, according to panelists at RIA Edge.

Nerd's Eye View

OCTOBER 4, 2023

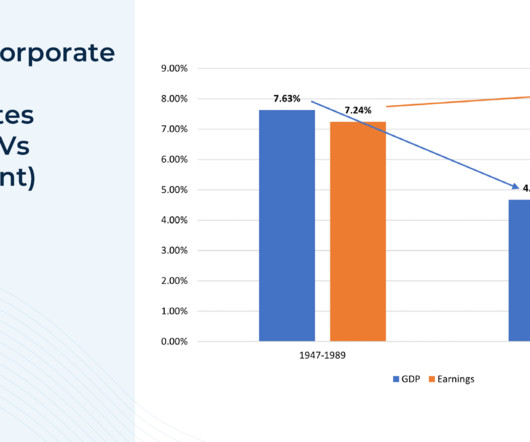

The expectations for the future economic outlook also appear in the valuations of equities, which tend to reflect how markets anticipate that corporate earnings will grow in the future.

Wealth Management

MARCH 5, 2025

Tips for avoiding IRS scrutiny in an audit.

Wealth Management

MARCH 15, 2024

Christopher P. Woehrle discusses a court case that focuses on how to document correctly the charitable deduction from a syndicated conservation easement.

Advisor Perspectives

JULY 1, 2025

Here is the latest update of a popular market valuation method, Price-to-Earnings (P/E) ratio, using the most recent Standard & Poor's "as reported" earnings and earnings estimates, and the index monthly average of daily closes for the past month. The latest trailing twelve months (TTM) P/E ratio is 27.2

Wealth Management

JUNE 22, 2023

The “denominator effect” put institutions in a position where real estate allocations exceeded target levels, but observers expect that issue has begun to resolve itself as values of other investments have recovered.

Wealth Management

JANUARY 3, 2024

Should company-owned life insurance used to redeem stock be included in valuing a decedent’s ownership interest?

Abnormal Returns

OCTOBER 30, 2024

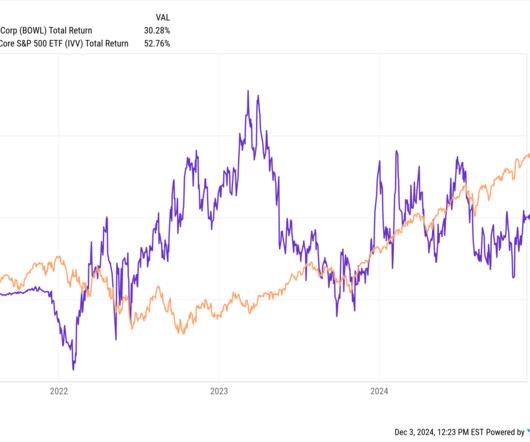

johnwallstreet.com) A closer look at rising NBA valuations. (macworld.com) Sports How Callaway's ($MODG) bet on TopGolf went wrong. on.ft.com) How MLB teams can hedge against player underperformance. huddleup.substack.com) An existential threat to pro sports: kids don't watch live sports. frontofficesports.com) Economy 2024 Q3 GDP ran at a 2.8%

Wealth Management

MARCH 31, 2025

Median-adjusted EBITDA multiples hit a near-decade high in 2024, according to Advisor Growth Strategies, and a deal market of more than 40 buyers looks to keep things frothy in 2025.

Wealth Management

JUNE 28, 2024

Gurbir Grewal said he sees a range of potential risks in the $1.7 trillion private-lending industry.

Nerd's Eye View

FEBRUARY 11, 2025

David is the President of Succession Resource Group, an advisory consulting and valuation business based in Portland, Oregon that serves independent financial advisors with RIAs and broker-dealers. Welcome to the 424th episode of the Financial Advisor Success Podcast ! My guest on today's podcast is David Grau, Jr.

Advisor Perspectives

JUNE 3, 2025

Our monthly market valuation updates have long had the same conclusion: US stock indexes are significantly overvalued, which suggests cautious expectations for investment returns. This analysis focuses on the P/E10 ratio, key indicator of market valuation, and its correlation with inflation and the 10-year Treasury yield.

Nerd's Eye View

JANUARY 31, 2025

Which could include measures such as additional time to comply with rules that have been adopted but not yet enforced and perhaps, more broadly, an approach from the SEC that focuses more on whether a firm has robust program controls and a strong fiduciary culture rather than seeking out specific, (sometimes minor) missteps and producing enforcement (..)

Abnormal Returns

DECEMBER 3, 2024

techcrunch.com) Musk SpaceX could soon be the world's most valuable startup with a $350 billion valuation. theverge.com) Fidelity marked up its valuation of X. (wsj.com) Meta ($META) is reportedly investing $10 billion in subsea cables. finance.yahoo.com) Elon Musk's Tesla ($TSLA) pay package was rejected, again.

Wealth Management

JANUARY 29, 2024

Larry Swedroe: Falling valuations mean that future expected returns are higher.

Abnormal Returns

FEBRUARY 11, 2024

(allstarcharts.com) A valuation analysis of the Magnificent Seven. barrons.com) Valuations matter, but using them in your investment process is a challenge. entrylevel.topdowncharts.com) A look at Magnificent Seven valuations. aswathdamodaran.blogspot.com) In the long run, fundamentals matter.

Nerd's Eye View

JUNE 27, 2025

Also in industry news this week: While the estate tax exemption is slated to rise to $15 million in 2026 under Republican-proposed legislation, estate planning will remain a key topic for advisors and their clients across the wealth spectrum, from managing possible state estate tax exposure to ensuring that clients’ end-of-life preferences are (..)

Wealth Management

MARCH 12, 2024

Rising valuations and growing opportunities for media rights and sponsorships make professional sports teams an attractive bet. However, data on how these investments will work in the long term remains scarce.

Nerd's Eye View

JANUARY 3, 2025

Also in industry news this week: A survey indicates that workplace retirement plan participants with financial advisors tend to save more than their non-advised counterparts and that a strong majority of participants overall are interested in receiving professional advice (with more than 3/4 of this group expressing willingness to pay for it) A look (..)

Wealth Management

FEBRUARY 14, 2024

Valuations in the private real estate market are finally starting to reflect higher interest rates and tighter debt availability.

Abnormal Returns

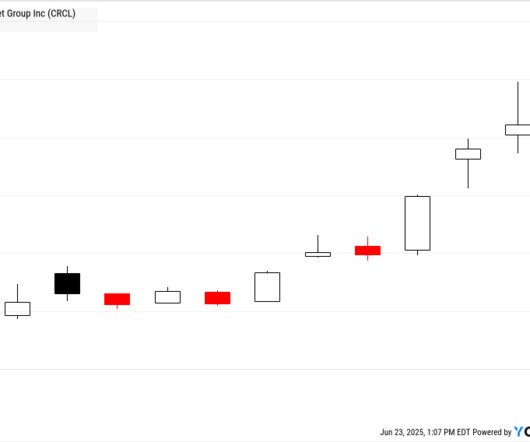

JUNE 23, 2025

axios.com) AI How Thinking Machines Lab raised $2 billion at at $10 billion valuation. (wealthmanagement.com) Why Vanguard is restructuring its asset management group. thinkadvisor.com) FICO credit scores will now include BNPL data. ft.com) Checking in on the Big Five and their AI efforts.

Wealth Management

FEBRUARY 28, 2025

The SEC's worries over the Apollo Global/State Street private credit ETF center on the funds liquidity, its name and its ability to comply with valuation rules.

Wealth Management

DECEMBER 12, 2024

Falling interest rates and the disappearance of a valuation gap with private real estate should also add tailwinds for publicly listed real estate.

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content