Investing Behavioral Hacks

The Big Picture

NOVEMBER 15, 2023

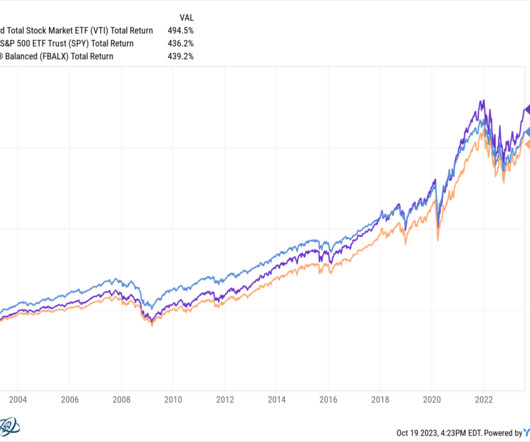

Instead, we can deploy small hacks to thwart your own worst instincts and behaviors ; by making small changes in your outlook and investment process, you can channel these behaviors into less destructive outlets. and it stops you from messing with your primary portfolio. ~~~ Good investing is boring. We all are! –

Let's personalize your content