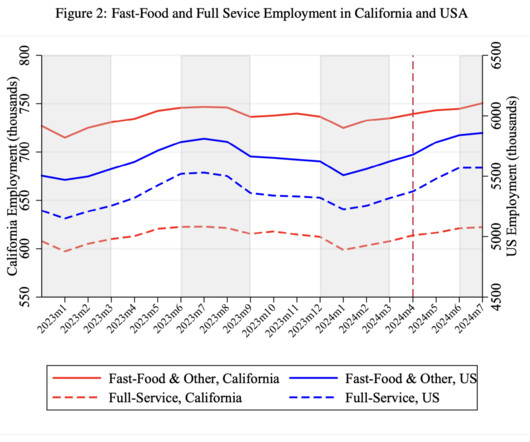

UPDATE: New CA QSR Min Wage Study. A Victory Lap.

The Big Picture

OCTOBER 7, 2024

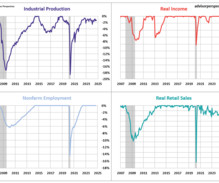

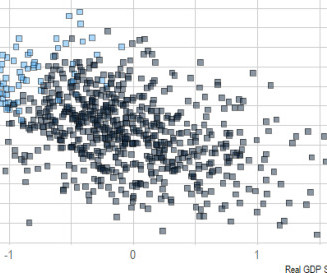

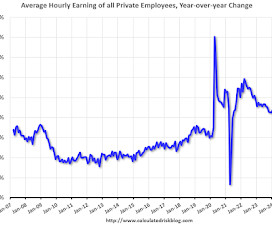

@TBPInvictus here: If you’re not aware of the brouhaha that was stirred about a year or so ago when CA Gov Gavin Newsom signed into law (taking effect April 1, 2024) a new $20 minimum wage for so-called “limited service” (a/k/a fast food or QSR) restaurant workers, read up here , here , or here. In a nutshell, the usual suspects’ heads exploded well before the legislation even took effect, claiming it would lead to widespread devastation in the fast food space: job losses

Let's personalize your content