Tuesday links: premium multiples

Abnormal Returns

JULY 23, 2024

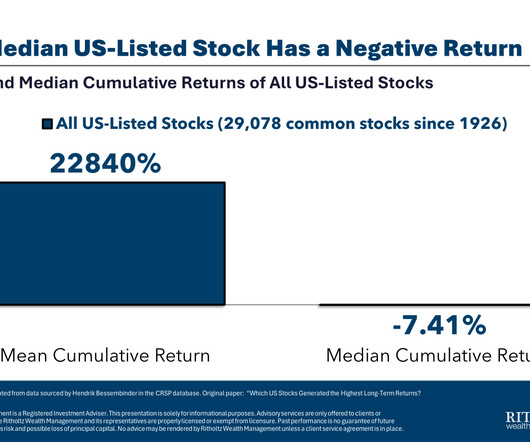

Markets Small caps have, relative to large caps, seen a lost decade. (ft.com) Joe Wiggins, "Everything within us and around us seems designed to interrupt the positive force of compounding." (behaviouralinvestment.com) Crypto What you need to know about the new spot Ethereum ETFs. (theblock.co) The players in the spot Ethereum space look familiar. (blockworks.co) What happens when you at Ethererum to a 60/40 portfolio.

Let's personalize your content