Balancing Multiple Residences: Navigating Tax Considerations, Legal Documentation, and Insurance Coverage for Snowbirds

Ballast Advisors

JUNE 18, 2024

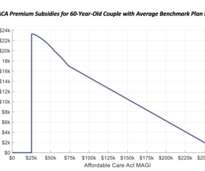

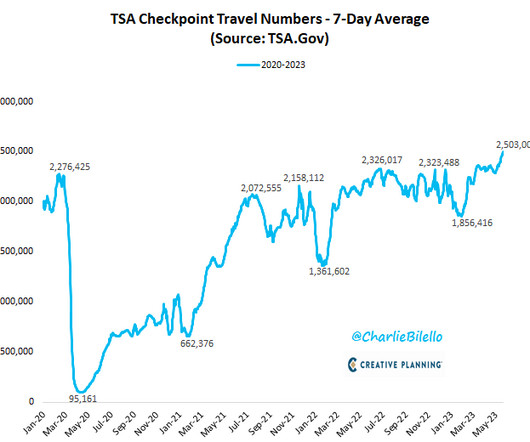

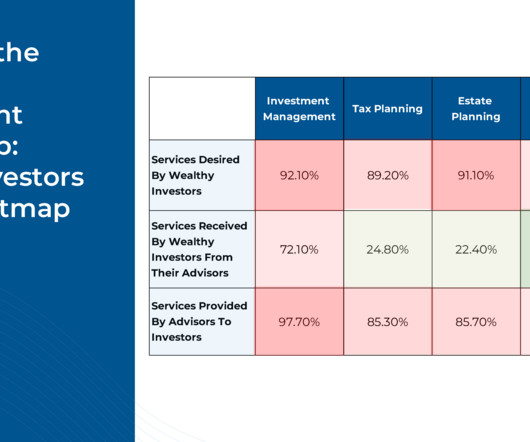

Join us as we delve into the tax strategy, legal documentation, and insurance coverage considerations needed to successfully balance the ownership of multiple residences for snowbirds. Review your coverage limits and consider factors such as driving habits and annual mileage.

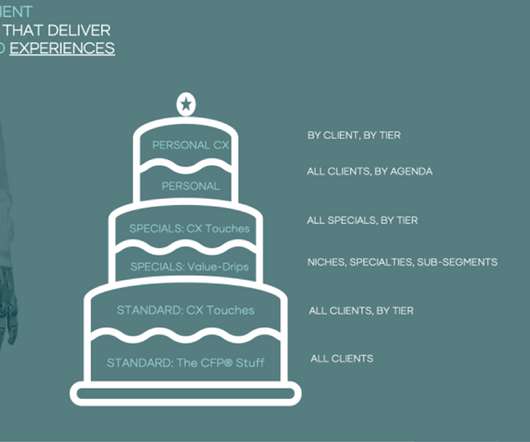

Let's personalize your content