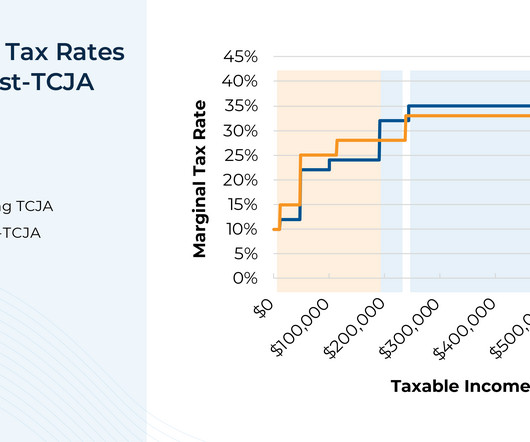

Planning For Changes In Client Marginal Tax Rates After TCJA’s Sunset

Nerd's Eye View

JULY 10, 2024

From an advisor's perspective, TCJA's impending expiration raises the importance of planning for clients who will potentially be impacted, which, given the law's broad scope, could be nearly every client. Read More.

Let's personalize your content