24/7 Financial Advice

The Big Picture

DECEMBER 7, 2022

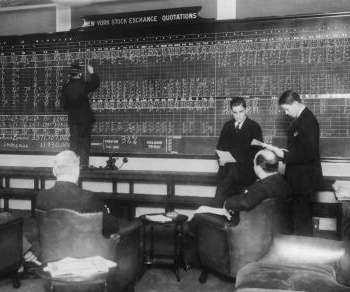

How does all of this “free financial advice” impact your collective psyche? The post 24/7 Financial Advice appeared first on The Big Picture. Viewership soared… ~~~. What are you getting from consuming 24/7 coverage of the world of economics, markets, and finance? Is it helping or hurting you?

Let's personalize your content