A Timeline Of Financial Markets

The Big Picture

MAY 1, 2023

Their failure sent shockwaves throughout France’s financial markets as investors rapidly sold off shares in a desperate attempt to minimize losses, which exacerbated the issue.

This site uses cookies to improve your experience. By viewing our content, you are accepting the use of cookies. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country we will assume you are from the United States. View our privacy policy and terms of use.

Financial Market Related Topics

Financial Market Related Topics

The Big Picture

MAY 1, 2023

Their failure sent shockwaves throughout France’s financial markets as investors rapidly sold off shares in a desperate attempt to minimize losses, which exacerbated the issue.

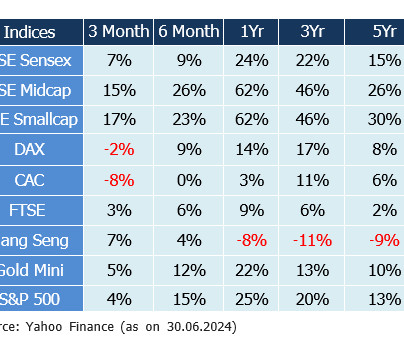

Truemind Capital

OCTOBER 18, 2024

That’s exactly what we’ve seen in India’s financial markets in the quarter ending September 2024. Here is what’s happening currently- Stock markets are rising Bond Prices are increasing / Bond Yields are falling Gold is trending upwards Real Estate Prices are inching upwards ALL KEY ASSET PRICES ARE GOING NORTHWARDS!

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

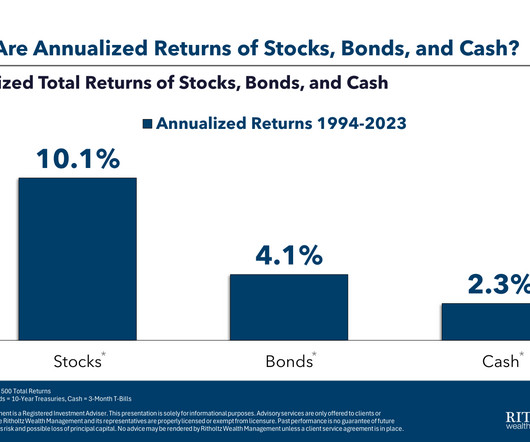

A Wealth of Common Sense

APRIL 28, 2024

A colleague recently asked me to run the 30 year annual returns for U.S. stocks, bonds and cash. He just wanted the returns. I couldn’t help but slice and dice the numbers and overanalyze the data because that’s what we do here. Let’s dig in.

A Wealth of Common Sense

JANUARY 17, 2023

You learn more about yourself during a bear market than a bull market. Last year was one of the worst for financial markets in modern eco. This piece I wrote at Fortune delves into 5 lessons for investors from 2022.

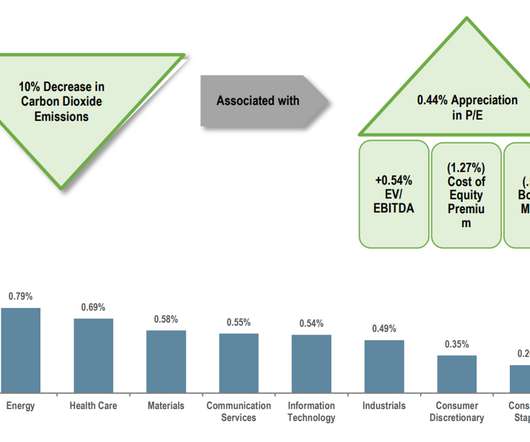

Alpha Architect

AUGUST 25, 2022

Financial Markets Responding to Climate Risks was originally published at Alpha Architect. We also find that a small discount emerges for corporate bonds, although it is statistically significant only for small caps. Please read the Alpha Architect disclosures at your convenience.

Trade Brains

NOVEMBER 7, 2023

Best Financial Markets to Trade : Are you looking to explore the best financial markets to trade in 2024? It is obvious that we may occasionally get confused in our decision-making when faced with the many different pieces of advice regarding financial planning, trading, and investments. What are Financial Markets?

Advisor Perspectives

MAY 30, 2024

As we set our sights on the summer, here are five dynamics that could drive the financial markets between Memorial Day and Labor Day:

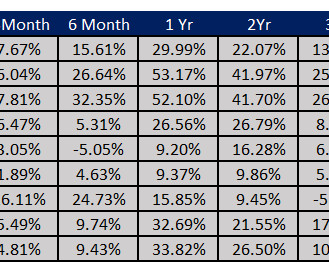

Truemind Capital

JULY 19, 2024

CONNECT WITH TRUEMIND ADVISOR The post Financial Market Round-Up – July’24 appeared first on Investment Blog. TRUEMIND’S MODEL PORTFOLIO – CURRENT ASSET ALLOCATION Truemind Capital is a SEBI Registered Investment Management & Personal Finance Advisory platform.

Investment Writing

JUNE 17, 2024

The post “High net worth” in your financial marketing appeared first on Susan Weiner Investment Writing. I’m grateful to everyone who answered my questions and shared their thoughtful comments. NOTE: This post was originally published on December 1, 2015, and updated on June 17, 2024.

Wealth Management

AUGUST 12, 2024

Rose Advisors' Patrick Fruzzetti details what advisors should consider when building investment portfolios for the current market environment.

Wealth Management

MARCH 22, 2024

Should wealth management storytelling tap into the feelings of the audiences it's targeting?

Truemind Capital

JANUARY 16, 2024

CONNECT WITH TRUEMIND ADVISOR The post Financial Market Round-Up – Jan’24 appeared first on Investment Blog. TRUEMIND’S MODEL PORTFOLIO – CURRENT ASSET ALLOCATION Truemind Capital is a SEBI Registered Investment Management & Personal Finance Advisory platform.

Truemind Capital

AUGUST 12, 2023

CONNECT WITH TRUEMIND ADVISOR The post Financial Market Round-Up – Jul’23 appeared first on Investment Blog. TRUEMIND’S MODEL PORTFOLIO – CURRENT ASSET ALLOCATION Truemind Capital is a SEBI Registered Investment Management & Personal Finance Advisory platform.

Truemind Capital

APRIL 21, 2023

years, our broad understanding ( click here to read) was: •Equity markets will underperform owing to pricey valuations • •Interest rates will rise •Gold could be a good portfolio hedge Positioning our client portfolios based on these expectations allowed us to yield positive returns, which neither benchmark indices nor longer-term debt funds could.

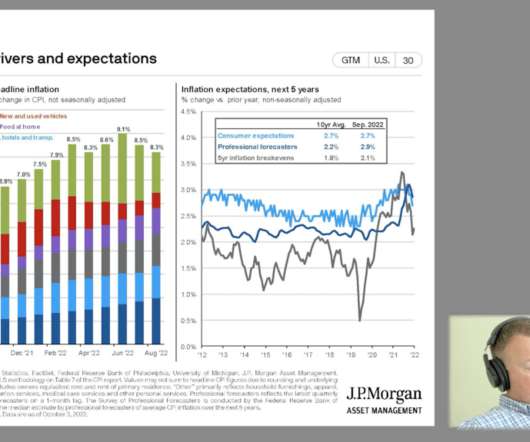

Walkner Condon Financial Advisors

OCTOBER 21, 2022

Armed with data from JPMorgan’s Guide to the Markets , Clint & Nate explore the drivers of inflation, U.S. market outperformance, bonds, and more. The post Financial Market Recap for Q3: Gimme Some Truth Podcast appeared first on Walkner Condon Financial Advisors. Send an email to podcast@walknercondon.com.

Wealth Management

MAY 11, 2023

Contrary to the current media narrative, certain real property segments—namely multifamily—have and continue to demonstrate solid performance.

Advisor Perspectives

OCTOBER 18, 2024

Fed easing cycles and lowered target interest rates impact various economic sectors, such as mortgages, consumer credit and cash investments.

International College of Financial Planning

FEBRUARY 3, 2024

The post Investing in the Future: Budget 2024’s Impact on Financial Markets appeared first on International College of Financial Planning.

oXYGen Financial

JUNE 28, 2023

[CDATA[ In an era where data has become the new oil, data privacy is no longer a peripheral concern but a central issue impacting sectors across the board, including financial markets. It signifies a shift in the way investors and. ]]

Advisor Perspectives

APRIL 1, 2024

What an impressive start to the year for US stocks! Not only did the S&P 500 Index achieve its largest first-quarter gain since 2019, it did so amidst significant challenges.

Abnormal Returns

OCTOBER 8, 2024

mrzepczynski.blogspot.com) Using AI to better explain past financial market returns. alphaarchitect.com) Some academic research that has informed our understanding of market returns. (etf.com) Index replication need not be entirely mechanistic. alphaarchitect.com) Volatility and anxiety are not the same thing.

Advisor Perspectives

JANUARY 6, 2024

The long-awaited recession never materialized in 2023 as the sectors of the economy rotated from hot (i.e., travel and leisure) to cold (i.e., housing) over the last few years.

Abnormal Returns

JULY 7, 2024

capitalspectator.com) Just how useful is historical financial markets data? downtownjoshbrown.com) Europe's stock market has badly lagged the U.S. Top clicks this week How major asset classes performed in June 2024. retirementresearcher.com) Don't forget, stocks are real assets. How much longer can it last?

Advisor Perspectives

JULY 26, 2023

With inflation falling and growth slowly grinding lower, time is running out on many global central bank tightening cycles – especially for the Federal Reserve (Fed) that meets next week.

Abnormal Returns

JULY 14, 2024

politico.com) Today's constructive CPI report rang a bell for financial markets. sherwood.news) How have the market's five largest stocks performed over the long run? ft.com) Just how much has indexing affected markets? Maybe this measure does.

Advisor Perspectives

APRIL 3, 2024

With technology changing the way we live, we are taking a trip down memory lane to look back at a piece of technology that has entertained generations: classic video games.

Wealth Management

MAY 23, 2024

Monday, June 17, 2024 | 2:00 PM Eastern Daylight Time

Abnormal Returns

MARCH 31, 2024

wsj.com) Gary Stevenson’s book “The Trading Game” helps explain the past twenty years in the financial markets. (capitalspectator.com) What will it take for small caps to outperform? ft.com) What it takes to add an EV charger in your garage. klementoninvesting.substack.com) There are no guarantees in life. Risk is everywhere.

Advisor Perspectives

OCTOBER 16, 2023

Franklin Templeton Fixed Income Research Analysts Ashley Allen and Bryant Dieffenbacher discuss the food, water and energy sectors and what their convergence means for investors.

Abnormal Returns

JULY 2, 2024

mrzepczynski.blogspot.com) Just how useful is historical financial markets data? marketwatch.com) When a company shifts its financial targets - take note. Quant stuff Beware small sample sizes. bpsandpieces.com) Corporate finance Are companies any good at timing share repurchases?

Wealth Management

OCTOBER 17, 2024

The performance of financial markets, particularly equities, doesn’t hinge on who is sitting in the Oval Office.

Advisor Perspectives

DECEMBER 17, 2023

As markets staged a monster rally following the Federal Reserve’s shift toward loosening monetary policy, one corner of the financial system had reason to remain on edge.

Abnormal Returns

MAY 21, 2024

papers.ssrn.com) How 'good' and 'bad' inflation affect financial markets. papers.ssrn.com) A round-up of research on market analytics including 'Regime-Based Strategic Asset Allocation.' (mrzepczynski.blogspot.com) Global pricing models are a better way forward. papers.ssrn.com) How complex 10-Ks affect analyst forecasts.

Advisor Perspectives

OCTOBER 8, 2024

Just like road trips can bring unexpected detours, the economy and financial markets are at their own crossroads: recession or soft landing?

Abnormal Returns

OCTOBER 29, 2023

Top clicks this week A big regime shift has happened in the economy and financial markets. ritholtz.com) The bond market bear market is pretty epic. mrzepczynski.blogspot.com) Byron Wien's 20 rules for investing and life. ritholtz.com) Why aren't stocks down more?

The Big Picture

JANUARY 25, 2023

The researchers describe financial markets as “slowly evolving communities of practice whose habits, routines and ways of knowing can be difficult to shift, even when faced with overwhelming evidence that what they are doing doesn’t work most of the time.”

Abnormal Returns

JUNE 28, 2024

bnnbloomberg.ca) The financial markets are noisy. Strategy Is the small cap premium dead? awealthofcommonsense.com) Home bias illustrated: the case of Canadian investors. You need a path through. marknewfield.substack.com) Companies Accenture ($ACN) is making bank on generative AI.

Advisor Perspectives

MARCH 17, 2023

In a dovish move, the central bank raises rates by half a point.

Advisor Perspectives

OCTOBER 16, 2024

Machine learning is ubiquitous in financial markets, and we tend to associate it with the sexy parts of hedge fund investing: what to buy, what to sell and how to pick a bottom or a top.

Wealth Management

AUGUST 14, 2024

The Securities Industry and Financial Markets Association filed a lawsuit against the regulation that took effect last year, saying there was “no precedent for it in the securities laws.”

The Big Picture

SEPTEMBER 15, 2023

Tune in for a deep dive into the financial markets with Barry, who reveals how his background in behavioral finance and his fearless approach when launching his blog, the “Big Picture,” earned him the reputation as “one of the most dangerous people in financial media.”

Pragmatic Capitalism

SEPTEMBER 19, 2022

I joined Dr. Daniel Crosby on the Standard Deviations podcast for a wide ranging discussion about portfolio management and navigating the conspiracy theories of the financial markets. This one’s short [ … ]

Abnormal Returns

JANUARY 1, 2023

topdowncharts.substack.com) Six things that don't change in financial markets including the attraction of 'shiny objects.' (crossingwallstreet.com) The best books Ben read in 2022 including "Die With Zero" by Bill Perkins. awealthofcommonsense.com) A look at the best charts of 2022.

Abnormal Returns

JULY 11, 2024

Markets Today's constructive CPI report rang a bell for financial markets. finance.yahoo.com) The market for leveraged loans is open for business, especially refinancings. sherwood.news) Falling interest rates helped push 30-year mortgage rates well below 7.0%.

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content