Adviser links: phased retirements

Abnormal Returns

JULY 1, 2024

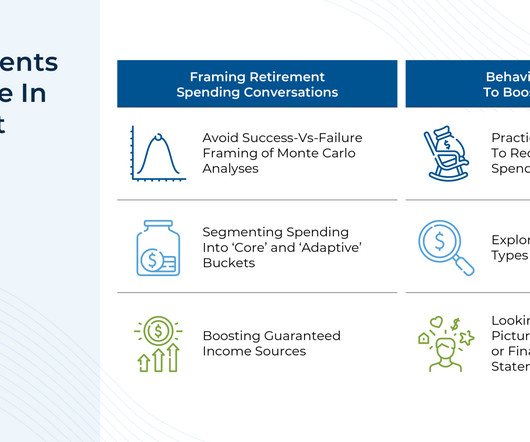

Podcasts Amy Arnott and Christine Benz talk with Don Graves and Wade Pfau about the role of home equity in retirement planning. riabiz.com) Fisher Investments is spinning off its 401(k) business, Fisher Retirement Solutions. kitces.com) Spending in retirement can increase with the use of lifetime income solutions.

Let's personalize your content