Live from Heckerling: 2023 Estate and Tax Planning Developments

Wealth Management

JANUARY 8, 2024

What were the significant tax and non-tax issues of last year? Speakers at Heckerling discuss tax planning, estate planning and philanthropy cases.

This site uses cookies to improve your experience. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country, we will assume you are from the United States. Select your Cookie Settings or view our Privacy Policy and Terms of Use.

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Used for the proper function of the website

Used for monitoring website traffic and interactions

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Tax Planning Related Topics

Tax Planning Related Topics

Wealth Management

JANUARY 8, 2024

What were the significant tax and non-tax issues of last year? Speakers at Heckerling discuss tax planning, estate planning and philanthropy cases.

Nerd's Eye View

JUNE 18, 2025

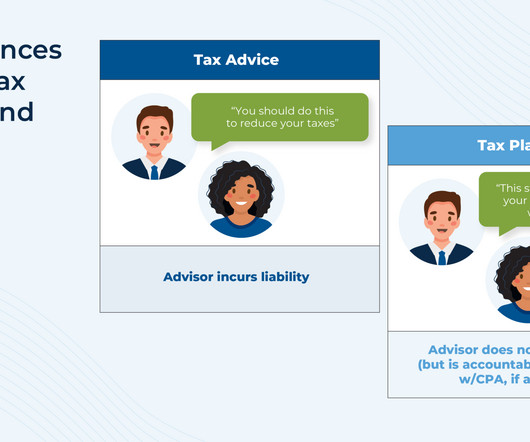

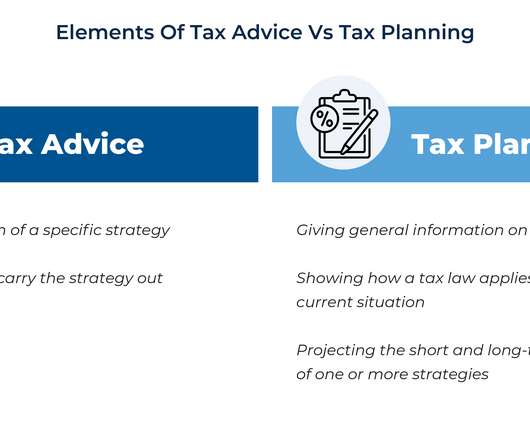

In recent years, financial advisors have increasingly embraced tax planning as a core element of delivering value to clients. Despite this growing interest in tax conversations, most advisors are still quick to distinguish their services as "tax planning", not "tax advice" – a distinction largely driven by liability concerns.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Wealth Management

MARCH 7, 2025

Carson, Mesirow and Sequoia are recent RIA dealmakers in the growing push to add tax planning and services.

Nerd's Eye View

NOVEMBER 30, 2022

And the consequences for incorrect tax advice can include legal and financial penalties if a client were to be harmed by the wrong advice – which is often not covered by the firm’s E&O insurance –creating an expensive liability when tax advice goes wrong.

Wealth Management

MARCH 23, 2023

Make the most of available charitable tax deductions.

Nerd's Eye View

JANUARY 21, 2025

What's unique about Daniel, though, is how his firm has expanded its tax focus to include "in-house" tax return preparation for its clients as a one-stop shop, but actually outsources the tax preparation work itself to trusted CPAs that he pays out of his own revenue (rather than bringing this service fully in-house) so that he can focus his staff (..)

Wealth Management

OCTOBER 15, 2024

Thursday, November 14, 2024 | 2:00 PM ET

Carson Wealth

FEBRUARY 13, 2025

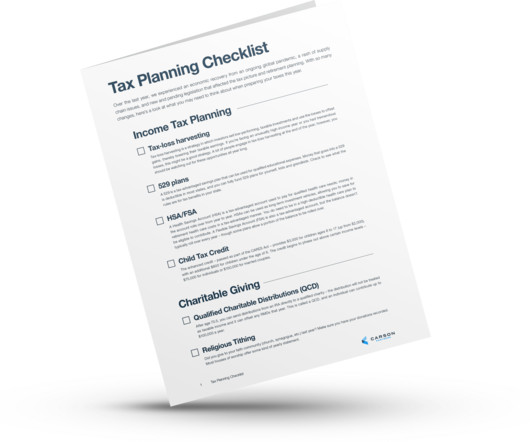

To help you make the best decisions regarding your taxes, retirement savings, and charitable giving, here are a few of the common planning opportunities and current tax benefits to consider as you update your plans for this year. The post Tax Planning Checklist appeared first on Carson Wealth.

Wealth Management

AUGUST 15, 2022

Some advisors who have built their practices on ETFs and mutual funds have never experienced a market correction like the one we are in now.

Nerd's Eye View

JULY 4, 2025

Enjoy the current installment of "Weekend Reading For Financial Planners" – this week's edition kicks off with the news that Congress has passed highly anticipated tax legislation, making 'permanent' (i.e.,

Abnormal Returns

NOVEMBER 6, 2024

podcasts.apple.com) Taxes A year-end tax planning checklist. kindnessfp.com) How to think about taxes in early retirement. (morningstar.com) Barry Ritholtz talks shareholder yield with Meb Faber of Cambria Investments. ritholtz.com) Carl Richards talks avoiding burnout with Jonny Miller.

Nerd's Eye View

NOVEMBER 28, 2024

Still others may choose a hybrid model, combining AUM fees with additional charges for other services like tax planning. Others may align with broader industry trends, like transitioning to fee-only structures to buffer against market volatility.

Nerd's Eye View

JUNE 13, 2025

Other key findings from the survey included a gap between long-term investment return expectations of investors and advisors (12.6%

Nerd's Eye View

DECEMBER 27, 2024

Also in industry news this week: According to a recent survey, advisors are putting an increasing share of client assets into model portfolios, allowing for customization and time savings that advisors appear to be using to provide more comprehensive planning services RIA M&A deal volume saw an annual record in 2024 as a lower cost of capital, (..)

Wealth Management

JULY 24, 2023

Charles Lubar, retired senior counsel from McDermott Will & Emery, details the complexities in dealing with tax implications of projects involving the Muppets and Michael Jackson.

Wealth Management

JULY 26, 2023

There’s a natural partnership between financial advisors and CPAs.

Wealth Management

JULY 26, 2023

There’s a natural partnership between financial advisors and CPAs.

Nerd's Eye View

NOVEMBER 15, 2024

Also in industry news this week: NASAA has proposed an amendment to its broker-dealer conduct model rule that would restrict the use of the terms “advisor” and “adviser” for broker-dealers and their registered representatives who are not also investment advisers or investment adviser representatives A recent study suggests that (..)

Nerd's Eye View

NOVEMBER 19, 2024

So, whether you're interested in learning about building a profitable hyperfocused practice, implementing a marketing approach that reaches a firm's ideal target client, or adding value for clients by offering advanced tax planning, then we hope you enjoy this episode of the Financial Advisor Success Podcast, with Anjali Jariwala.

Harness Wealth

NOVEMBER 12, 2024

As the year comes to a close, now is the time to review potential financial moves to help minimize your tax burden heading into 2025. Proactive year-end tax planning can lead to significant savings and set you up for financial success in the new year. This is a product of Harness Tax LLC.

Nerd's Eye View

JUNE 24, 2025

In this episode, we talk in-depth about how Griffin leverages his own experience as a firm founder to support his business-owner clients navigate financial planning decisions (in particular, tax planning opportunities), how Griffin encourages his business-owner clients to invest a portion of their profits outside of the business to diversify their (..)

Abnormal Returns

NOVEMBER 11, 2024

thinkadvisor.com) A year-end tax planning checklist. (advisorperspectives.com) A three-part approach to developing a 'statement of financial purpose.' kitces.com) What it means to be a great adviser to retired clients. kindnessfp.com) Why it's so easy to lose focus. advisorperspectives.com)

Wealth Management

JULY 2, 2025

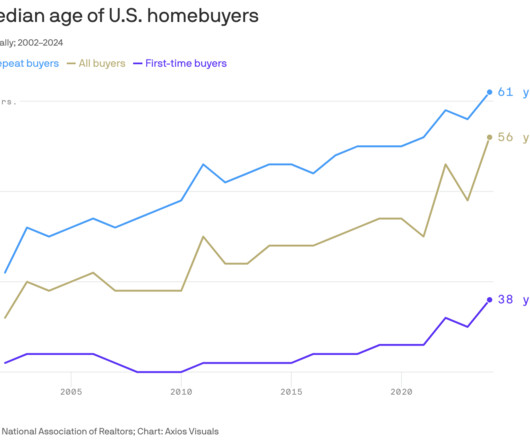

As a result, financial advisors should start honing the services Gen X members will likely benefit from the most, including retirement planning, estate and tax planning and mortgage refinancing. Gen X, or those currently aged between 45 and 60 years, will receive nearly $13.9 trillion annually.

Wealth Management

JANUARY 6, 2025

Tim Tallach has joined as director of advanced tax planning and family office services, as the RIA continues to expand its family office division.

Nerd's Eye View

MAY 16, 2025

Enjoy the current installment of "Weekend Reading For Financial Planners" - this week's edition kicks off with the news that Republicans in the House of Representatives this week released their long-awaited tax plan to address the impending sunset of many measures in the 2017 Tax Cuts and Jobs Act.

Abnormal Returns

SEPTEMBER 8, 2024

awealthofcommonsense.com) Early in retirement is the time to do some tax planning. Top clicks this week High yields come with risk. Don't let anyone tell you otherwise. wsj.com) Three reasons why the stock market declines. whitecoatinvestor.com) Three reasons to buy Josh Brown's new book "You Weren’t Supposed To See That."

Wealth Management

NOVEMBER 14, 2024

Kevin Knull, President of TaxStatus, reveals how a direct integration with the IRS is revolutionizing tax planning at Nitrogen's 2024 Fearless Investing Summit.

Nerd's Eye View

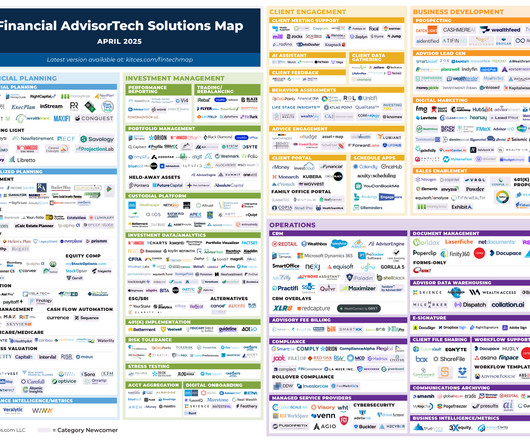

APRIL 7, 2025

Advisor workflow support solution Hubly has been acquired by Docupace, which suggests that Hubly might have struggled to gain a critical mass of users as a solution to help solve the shortcomings of advisor CRM systems' workflow capabilities – especially given that the price of Hubly was often as much or more expensive than the CRM platforms (..)

Integrity Financial Planning

SEPTEMBER 19, 2022

So, make sure your Social Security and retirement account income plans are lined up so you can claim your maximum benefit with minimal taxation. Don’t just wait until tax season to figure out your tax plan. Taxes affect your whole retirement so factor them into your wealth preservation and income plan too.

Abnormal Returns

JANUARY 15, 2025

podcasts.apple.com) Retirement Retirement is a great time to do some creative tax planning. (podcasts.apple.com) Shane Parrish talks with Codie Sanchez author of "Main Street Millionaire: How to Make Extraordinary Wealth in Ordinary Businesses." awealthofcommonsense.com) The best retirement withdrawal strategy is one you can live with.

Wealth Management

NOVEMBER 6, 2024

Smith, executive director with Eaton Vance, discusses tax law changes in 2026 and emphasizes the importance of proactive tax planning for investors.

Nerd's Eye View

NOVEMBER 1, 2024

Also in industry news this week: A recent study suggests that while a majority of financial advisory clients surveyed have only had 1 advisor, deteriorating client service is a key risk factor that could sway certain clients to leave for a different advisor RIA M&A activity in 2024 is poised to surpass the total number of deals seen in 2023, according (..)

A Wealth of Common Sense

NOVEMBER 7, 2024

Bill Artzerounian joined me on this show this week to talk about the election’s impact on your taxes, the downsides of early retirement, tax planning for retirement and when to fill up your Roth buckets for retirement savings.

Wealth Management

JULY 11, 2024

Earned Wealth, founded in 2021, offers medical professionals advice on financial planning, tax planning, wealth management and investing on one interconnected platform.

Abnormal Returns

NOVEMBER 18, 2024

justincastelli.io) Taxes Some speculation on what is next for the TCJA. kitces.com) Tax planning and wealth management go hand-in-hand. downtownjoshbrown.com) How tax deferment can backfire. (podcasts.apple.com) Bogumil Baranowski talks with Justin Castelli about living an authentic life.

Wealth Management

MARCH 12, 2025

The changes, which take effect September 2025, expand the CPWAs curriculum related to human dynamics, tax planning and specialty client strategies.

Nerd's Eye View

OCTOBER 28, 2024

Plus a few events that are simply great well-rounded experiences for those who want to enjoy the conference, the destination, the sessions they attend, and their fellow attendees.

Wealth Management

APRIL 3, 2025

Steven Jarvis, the founder and CEO of Retirement Tax Services, offers advice on how a CPA can help increase the growth and enterprise value of an advisors business.

Covisum

AUGUST 5, 2022

The Tax Cuts and Jobs Act simplified many aspects of tax planning and created opportunities. As a result, some tax techniques are more effective now than in the past. Additionally, the personal exemption phase-out and the limitation on itemized deductions for some filers were eliminated.

Financial Symmetry

OCTOBER 21, 2024

When thinking about preparing tax returns each year, many taxpayers have a binary view about the outcome that looks something like this: Owe Tax: BAD Receive Refund: GOOD While this may be the case if you are living paycheck-to-paycheck and … Continued The post Goals of Tax Planning appeared first on Financial Symmetry, Inc.

Wealth Management

FEBRUARY 3, 2023

This week, Orion announced they were making it easier for those in need of free financial planning to find help, TIFIN and Morningstar partnered to enhance their AI-powered distribution platform and eMoney responded to recently-passed legislation with tax planning upgrades.

Nerd's Eye View

SEPTEMBER 25, 2024

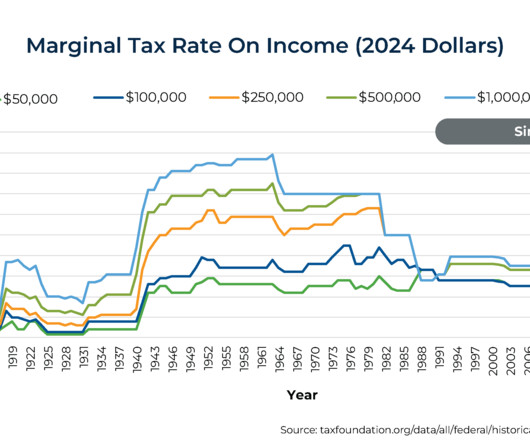

Because not only were very few households actually subject to the 1950s-era top tax rates (which were triggered at the equivalent of over $2 million of income in today's dollars), but the long decline in nominal tax rates has also come with the elimination of many loopholes and deductions that have resulted in more income being subject to tax.

XY Planning Network

JULY 7, 2023

Available exclusively to XYPN members, each month one of XYTS's tax experts hosts an office hours session where tax-specific topics are discussed and attendees can ask any top-of-mind questions.

Wealth Management

JUNE 10, 2025

RIA Edge Podcast: Schwab’s Jalina Kerr on How Resilient RIAs Can Turn Market Volatility Into Growth RIA Edge Podcast: Schwab’s Jalina Kerr on How Resilient RIAs Can Turn Market Volatility Into Growth Jalina Kerr of Charles Schwab shares how the most adaptive firms are expanding beyond portfolio management, into areas like estate and tax planning.

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content