Impact of New $15M 'Permanent' Estate/Gift Tax Exemption

Wealth Management

JULY 7, 2025

Explore how the new $15 million federal estate tax exemption affects lifetime transfer planning and strategies for high-net-worth clients.

Wealth Management

JULY 7, 2025

Explore how the new $15 million federal estate tax exemption affects lifetime transfer planning and strategies for high-net-worth clients.

Calculated Risk

JULY 11, 2025

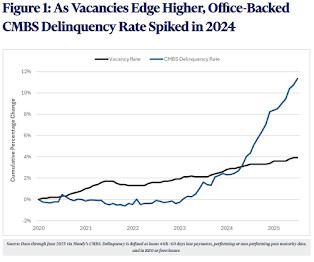

From Nick Villa at Moody's The Office Sector’s Double Whammy The ongoing challenges affecting the office sector have not only resulted in deteriorating space market fundamentals—evidenced by the record-high national office vacancy rate in the second quarter of 2025—but have also had a direct negative impact on capital market activities, including the performance of commercial mortgage-backed securities (CMBS).

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Abnormal Returns

JULY 7, 2025

Podcasts Michael Batnick talks with Jason Wenk, CEO of Altruist, about the changing custody landscape. (youtube.com) Jeff Bernier talks with Larry Swedroe about the the evolving role of alternative assets like private credit and reinsurance in modern portfolios. (youtube.com) Barry Ritholtz talks with Kate Moore, chief investment officer at Citi Wealth.

The Big Picture

JULY 5, 2025

The weekend is here! Pour yourself a mug of Colombia Tolima Los Brasiles Peaberry Organic coffee, grab a seat outside, and get ready for our longer-form weekend reads: • JPMorgan’s Risky, 5-Day Dash to Help Warner Bros. Split in Two : Offering creditors a deal that would leave them with billions less than they were owed, despite the notes having an investment-grade rating.

Advertisement

Automation generally supercharges any process and brings its value to the forefront. See how infusing automation such as ART (our month-end close solution), into your close can get you to the next level of closing. We will share a live demo of SkyStem's solution, ART and share the key elements of month-end close automation. Through ART, we'll take a look at: What month-end close automation entails Which process steps can and should be automated Benefits of achieving process automation, and Why i

Nerd's Eye View

JULY 9, 2025

Financial planning meetings often fall into categories like "Fix Meetings" (where there is an urgent problem that both the advisor and client want to address), 'Fine Meetings' (where everything is on track and the advisor provides reinforcement), or 'Flourish Meetings' (where clients are thriving and the focus is on expanding possibilities). However, another type of meeting occurs when the client isn't in crisis but has clearly drifted off track (e.g., spending more than planned, which could lea

Wealth Management

JULY 7, 2025

Bill Ramsay, the founder of Financial Symmetry, grew his RIA Edge 100 RIA firm organically with shared employee ownership and an internship program that has led to a young, invested team.

Financial Advisor Source brings together the best content for financial advisor professionals from the widest variety of industry thought leaders.

Abnormal Returns

JULY 6, 2025

Also on the site this week. Newer, cheaper, better isn't always. (abnormalreturns.com) Make sure you stay on top of everything on Abnormal Returns. Sign up for our (free) daily e-mail newsletter. (abnormalreturns.com) Are you a financial advisor? Sign up for our (free) weekly advisor-focused newsletter. (newsletter.abnormalreturns.com) Top clicks this week Most investors don't understand the yield on option strategy ETFs.

The Big Picture

JULY 5, 2025

Good conversation with Sammy Azzous: Barry blends behavioral finance with data analysis to uncover some of the most common (and costly) investing mistakes — and how to steer clear of them. Tune in for actionable takeaways on failing better, managing market noise, and navigating the world of financial “experts.” Plus, Barry explains why the childhood advice “Don’t take candy from strangers” also holds true for grown-up investors.

Nerd's Eye View

JULY 11, 2025

Enjoy the current installment of "Weekend Reading For Financial Planners" - this week's edition kicks off with the news that, amidst the growing number of RIAs it supervises, the Securities and Exchange Commission (SEC) is moving ahead with a potential plan to raise the $100 million regulatory assets under management threshold for SEC registration, with the regulator having talks with some state securities regulators (which would bear an increasing regulatory burden if the threshold were lifted

Wealth Management

JULY 8, 2025

BlackRock made another move to bolster its private market capabilities with the acquisition of net lease real estate firm ElmTree Funds. Private investment platform Linqto, which promised access to pre-IPO firms, filed for bankruptcy amid SEC scrutiny of its practices. These are among the investment must-reads we found this week for financial advisors.

Speaker: Victor C. Barnes, CPA, MBA

In the climb from contributor to leader, the rules quietly change. If you’re aiming for the summit, the air gets thinner—and what got you here won’t be enough to get you to the top (a concept first popularized by Marshall Goldsmith in his book What Got You Here Won’t Get You There ). What made you successful early in your finance career—technical accuracy, sharp analysis, flawless execution—won’t be what carries you to the next level.

Calculated Risk

JULY 9, 2025

Different views on possible rate cuts (see paragraph 2). From the Fed: Minutes of the Federal Open Market Committee, June 17–18, 2025. Excerpt: In considering the outlook for monetary policy, participants generally agreed that, with economic growth and the labor market still solid and current monetary policy moderately or modestly restrictive, the Committee was well positioned to wait for more clarity on the outlook for inflation and economic activity.

Abnormal Returns

JULY 11, 2025

The biz The New York Times ($NYT) wants to turn its writers into video stars. (vulture.com) The scam that is using an appearance on a big name podcast as bait. (thewrap.com) Economy Ezra Klein talks the attention economy with Kyla Scanlon, author of "In This Economy?: How Money & Markets Really Work." (podcasts.apple.com) Danny Crichton and Laurence Pevsner talk with Yoni Applebaum, author of “Stuck: How the Privileged and the Propertied Broke the Engine of American Opportunity.

The Big Picture

JULY 7, 2025

I had a fun conversation with Adam Gower, who runs Gower Crowd — a real estate capital sourcing firm that “builds digital marketing platforms for real estate sponsors.” He also hosts a podcast, The Real Estate Market Watch ( Apple , Spotify , YouTube ). Discussing risk, noise, and uncertainty from a real state perspective led to a fun conversation.

Nerd's Eye View

JULY 10, 2025

As the financial advice profession has matured, behavioral finance has become an increasingly important element of modern advice. This holistic approach to financial advice, often referred to as life planning, focuses on helping the advisor understand the client’s financial history, deep-seated goals, and overall relationship with money, which can allow for more targeted and comprehensive advice.

Speaker: Kim Beynon, CPA, CGMA, PMP

The most overlooked, yet most critical, element of transformation is preparing people for change. Automation and AI aren't just technical upgrades, they’re cultural shifts which can challenge identities. That’s why change management isn’t a side project—it’s the foundation. In finance, where precision and process rule, navigating change can feel especially disruptive.

Wealth Management

JULY 9, 2025

Modern Wealth’s fourth deal of 2025, and 17th since its founding in 2023, adds a firm in its home state and bolsters a workplace retirement plan division launched last year via acquisition.

Calculated Risk

JULY 12, 2025

The key reports this week are June CPI, Retail Sales and Housing Starts. For manufacturing, the June Industrial Production report and the July New York and Philly Fed manufacturing surveys will be released. -- Monday, July 14th -- No major economic releases scheduled. -- Tuesday, July 15th -- 8:30 AM: The Consumer Price Index for June from the BLS. The consensus is for a 0.3% increase in CPI, and a 0.3% increase in core CPI.

Abnormal Returns

JULY 6, 2025

Markets Why we need to remind ourselves about market lessons over and over again. (tker.co) After Datadog ($DDOG), the next stocks that could be headed into the S&P 500. (sherwood.news) Trading Dark pools are taking market share and the exchanges are not happy about it. (barrons.com) Jane Street has been suspended from trading in India's stock market.

The Big Picture

JULY 9, 2025

At The Money: Managing Business Model Changes (July 9, 2025) What do you do when the business model of your chosen career changes radically? How can you adapt to changing conditions? (Full transcript coming tomorrow). ~~~ About this week’s guest: Sam Ro is a veteran financial journalist and CFA known for his clear, data-driven insights into markets and and the economy.

Advertisement

Where are top advisors focusing in 2025? AcquireUp’s 2025 Industry Index reveals it all. Based on insights from 200+ financial professionals nationwide, discover why 74% say seminars and referrals deliver the best ROI, how automation is helping advisors scale faster, and why only 8% are tapping into niche marketing (a major growth opportunity!). Whether you're refining your client acquisition strategy or scaling your practice, this report gives you the real-world data, benchmarks, and action ste

Nerd's Eye View

JULY 8, 2025

Welcome everyone! Welcome to the 445th episode of the Financial Advisor Success Podcast ! My guest on today's podcast is James Conole. James is the founder of Root Financial, an RIA based in Encinitas, California, that oversees $1.3 billion in assets under management for 630 client households. What's unique about James, though, is how his firm has experienced massive growth (expecting to grow its revenue from $4.6 million to more than $10 million in 2025 alone) thanks in part by attracting clien

Wealth Management

JULY 10, 2025

The commitments from T. Rowe Price, SurgoCap, BNY, State Street and others bring iCapital's valuation to $7.5 billion.

Calculated Risk

JULY 6, 2025

The first graph shows the unemployment rate by four levels of education (all groups are 25 years and older) through June 2025. Note: This is an update to a post from several years ago. Unfortunately, this data only goes back to 1992 and includes only three recessions (the stock / tech bust in 2001, and the housing bust/financial crisis, and the 2020 pandemic).

Abnormal Returns

JULY 8, 2025

Research If you are going to hedge, just hedge. (klementoninvesting.substack.com) Do factors matter for bond returns? Yes, they do. (alphaarchitect.com) Why there's alpha in the intangibles. (philbak.substack.com) AI models love momentum. (ft.com) Should you separate or combine your factor exposures? (alphaarchitect.com) Just how good a signal is insider ownership?

Speaker: Claire Grosjean, Global Finance & Operations Executive

Finance teams are drowning in data—but is it actually helping them spend smarter? Without the right approach, excess spending, inefficiencies, and missed opportunities continue to drain profitability. While analytics offers powerful insights, financial intelligence requires more than just numbers—it takes the right blend of automation, strategy, and human expertise.

Trade Brains

JULY 6, 2025

Debt can be a fantastic asset for driving business growth when handled correctly, but if it’s not managed well, it can take a serious toll on a company’s financial stability. In this article, we’ll look at four fundamentally strong companies that keep their debt levels low, showcasing their financial discipline and minimizing risk. 1. KNR Construction KNR Constructions Ltd, incorporated in 1995, is a Hyderabad-based infrastructure project development company providing EPC services in segments su

Million Dollar Round Table (MDRT)

JULY 10, 2025

By Kennedy Sumarlie, AWP Running out of prospects is a common concern for many financial advisors. It’s an issue we must face and take action on now if we want to have future clients. One way to address this is to ask existing clients for new contacts. For this to work well, though, we must go about it effectively. One of my good friends, Arvita Mersilia , a six-year MDRT member and Court of the Table member, asks for at least three recommendations from her clients when she delivers the insuranc

Wealth Management

JULY 8, 2025

WealthManagement.com is part of the Informa Connect Division of Informa PLC INFORMA PLC | ABOUT US | INVESTOR RELATIONS | TALENT This site is operated by a business or businesses owned by Informa PLC and all copyright resides with them. Informa PLC's registered office is 5 Howick Place, London SW1P 1WG. Registered in England and Wales. Number 8860726.

Calculated Risk

JULY 9, 2025

From the MBA: Mortgage Applications Increase in Latest MBA Weekly Survey Mortgage applications increased 9.4 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending July 4, 2025. Last week’s results included an adjustment for the July 4th holiday. The Market Composite Index, a measure of mortgage loan application volume, increased 9.4 percent on a seasonally adjusted basis from one week earlier.

Speaker: David Worrell, CFO, Author & Speaker

Your financial statements hold powerful insights—but are you truly paying attention? Many finance professionals focus on the income statement while overlooking key signals hidden in the balance sheet and cash flow statement. Understanding these numbers can unlock smarter decision-making, uncover risks, and drive long-term success. Join David Worrell, accomplished CFO, finance expert, and author, for an engaging, nontraditional take on reading financial statements.

Abnormal Returns

JULY 8, 2025

Markets No matter how you slice it, U.S. stocks are still expensive. (on.ft.com) Why gold has been moving higher: safe asset demand. (mrzepczynski.blogspot.com) Crypto The iShares Bitcoin ETF ($IBIT) holds more than 700,000 Bitcoin. (theblock.co) Another day, another new crypto Treasury company. (theblock.co) And another. (sherwood.news) Finance How private equity fund performance peaks and degrades over time.

Getting Your Financial Ducks In A Row

JULY 7, 2025

Photo credit: jb We’ve discussed here in the past about how it is a perfectly legal maneuver to make a non-deductible contribution to a traditional IRA and then at some point later convert the same contribution to your Roth IRA (see Is it Really Allowed? for more). If you have no other IRA accounts, this conversion to Roth can be a tax-free event, especially if there has been no growth or gains on the investments in the account.

The Big Picture

JULY 12, 2025

The weekend is here! Pour yourself a mug of Colombia Tolima Los Brasiles Peaberry Organic coffee, grab a seat outside, and get ready for our longer-form weekend reads: • Free-market economics is working surprisingly well : Which economic approach works depends a lot on where you start from. ( Noahpinion ) • ETFs Are Eating the World. The Right—and Wrong—Ways to Invest.

Wealth Management

JULY 9, 2025

Explore how the One Big Beautiful Bill Act impacts estate planning across wealth levels, emphasizing flexibility and income tax strategies for advisors.

Speaker: Cheryl J. Muldrew-McMurtry

Remote finance teams are rewriting how the back-office runs—and attackers are taking notes. Disconnected workflows, process blind spots, and rising cyber threats have become more than just “growing pains”. They’re now liabilities. The challenge isn’t just team distribution, but building resilient systems that protect accuracy, control, and speed across every transaction and touchpoint.

Let's personalize your content