BNY Taps iCapital to Beef Up Its Alternative Investment Capabilities

Wealth Management

JULY 8, 2025

BNY integrates iCapital with AltsBridge platform, attempting to streamline access to private market strategies and improve investment management.

Wealth Management

JULY 8, 2025

BNY integrates iCapital with AltsBridge platform, attempting to streamline access to private market strategies and improve investment management.

Nerd's Eye View

JULY 8, 2025

Welcome everyone! Welcome to the 445th episode of the Financial Advisor Success Podcast ! My guest on today's podcast is James Conole. James is the founder of Root Financial, an RIA based in Encinitas, California, that oversees $1.3 billion in assets under management for 630 client households. What's unique about James, though, is how his firm has experienced massive growth (expecting to grow its revenue from $4.6 million to more than $10 million in 2025 alone) thanks in part by attracting clien

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Wealth Management

JULY 8, 2025

Farther’s Taylor Matthews explores how the firm is seeking to improve the advisor experience and increase the operational efficiency of wealth management firms with home-built technology.

Calculated Risk

JULY 8, 2025

Note: Mortgage rates are from MortgageNewsDaily.com and are for top tier scenarios. Wednesday: • At 7:00 AM ET, The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

Advertisement

Automation generally supercharges any process and brings its value to the forefront. See how infusing automation such as ART (our month-end close solution), into your close can get you to the next level of closing. We will share a live demo of SkyStem's solution, ART and share the key elements of month-end close automation. Through ART, we'll take a look at: What month-end close automation entails Which process steps can and should be automated Benefits of achieving process automation, and Why i

Wealth Management

JULY 8, 2025

BlackRock made another move to bolster its private market capabilities with the acquisition of net lease real estate firm ElmTree Funds. Private investment platform Linqto, which promised access to pre-IPO firms, filed for bankruptcy amid SEC scrutiny of its practices. These are among the investment must-reads we found this week for financial advisors.

Abnormal Returns

JULY 8, 2025

Research If you are going to hedge, just hedge. (klementoninvesting.substack.com) Do factors matter for bond returns? Yes, they do. (alphaarchitect.com) Why there's alpha in the intangibles. (philbak.substack.com) AI models love momentum. (ft.com) Should you separate or combine your factor exposures? (alphaarchitect.com) Just how good a signal is insider ownership?

Financial Advisor Source brings together the best content for financial advisor professionals from the widest variety of industry thought leaders.

Abnormal Returns

JULY 8, 2025

Markets No matter how you slice it, U.S. stocks are still expensive. (on.ft.com) Why gold has been moving higher: safe asset demand. (mrzepczynski.blogspot.com) Crypto The iShares Bitcoin ETF ($IBIT) holds more than 700,000 Bitcoin. (theblock.co) Another day, another new crypto Treasury company. (theblock.co) And another. (sherwood.news) Finance How private equity fund performance peaks and degrades over time.

Wealth Management

JULY 8, 2025

RIAs should prioritize profitability over vanity metrics. Matt Sonnen reveals the key mistakes in tracking KPIs and how to focus on meaningful business growth.

Calculated Risk

JULY 8, 2025

Today, in the Calculated Risk Real Estate Newsletter: 1st Look at Local Housing Markets in June A brief excerpt: Tracking local data gives an early look at what happened the previous month and also reveals regional differences in both sales and inventory. Closed sales in June were mostly for contracts signed in April and May, and mortgage rates, according to the Freddie Mac PMMS, averaged 6.73% in April and 6.82% in May (slightly higher than for closed sales in May).

Wealth Management

JULY 8, 2025

WealthManagement.com is part of the Informa Connect Division of Informa PLC INFORMA PLC | ABOUT US | INVESTOR RELATIONS | TALENT This site is operated by a business or businesses owned by Informa PLC and all copyright resides with them. Informa PLC's registered office is 5 Howick Place, London SW1P 1WG. Registered in England and Wales. Number 8860726.

Speaker: Victor C. Barnes, CPA, MBA

In the climb from contributor to leader, the rules quietly change. If you’re aiming for the summit, the air gets thinner—and what got you here won’t be enough to get you to the top (a concept first popularized by Marshall Goldsmith in his book What Got You Here Won’t Get You There ). What made you successful early in your finance career—technical accuracy, sharp analysis, flawless execution—won’t be what carries you to the next level.

Calculated Risk

JULY 8, 2025

Note: Usually small business owners complain about taxes and regulations (currently 1st and 6th on the "Single Most Important Problem" list). During a recession, "poor sales" is usually the top problem and recently "inflation" was number 1. From the National Federation of Independent Business (NFIB): June 2025 Report: Small Business Optimism Index The NFIB Small Business Optimism Index remained steady in June, edging down 0.2 of a point to 98.6 , slightly above the 51-year average of 98.

Wealth Management

JULY 8, 2025

Beacon Pointe, based in Newport Beach, Calif., adds more than $2.7 billion in client assets by bringing on firms from Massachusetts to California and several female-led teams.

Calculated Risk

JULY 8, 2025

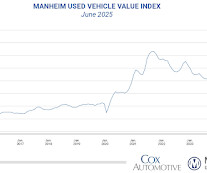

From Manheim Consulting today: Wholesale Used-Vehicle Prices Increase in June Wholesale used-vehicle prices (on a mix, mileage, and seasonally adjusted basis) were higher in June compared to May. The Manheim Used Vehicle Value Index (MUVVI) increased to 208.5, representing a 6.3% year-over-year increase and a 1.6% rise above May levels. The seasonal adjustment forced the index higher in the month, as non-seasonally adjusted values fell more than usual following the volatility induced by the tari

Wealth Management

JULY 8, 2025

In a letter responding to the Massachusetts senator’s concerns about Empower expanding alts access for employees’ defined contribution retirement plans, CEO Edmund Murphy argued the move is “not an open door—it’s a carefully monitored gateway.

Speaker: Kim Beynon, CPA, CGMA, PMP

The most overlooked, yet most critical, element of transformation is preparing people for change. Automation and AI aren't just technical upgrades, they’re cultural shifts which can challenge identities. That’s why change management isn’t a side project—it’s the foundation. In finance, where precision and process rule, navigating change can feel especially disruptive.

Trade Brains

JULY 8, 2025

The market responded in a bullish way on Tuesday. Indicating ongoing positive momentum, the Nifty 50 and BSE Sensex both finished higher, trading above all significant exponential moving averages. Improved retail confidence raised investor mood, although prudence persisted because of the expected results of the India-US trade pact. Due to robust stock-specific gains, the Realty and CPSE indexes performed better sectorally.

Carson Wealth

JULY 8, 2025

Buying a suit off the rack and wearing it “as is” can work. Buying a suit off the rack and tailoring it will likely give you a better fit and overall look. But there is nothing like a bespoke suit made just for you by a professional tailor. You can get the best fit possible when you have something made just for you. It can be designed to accentuate your best features, made in a color and style that will both please you and be appropriate for the occasion in which it will be worn.

Trade Brains

JULY 8, 2025

Hong Kong’s financial heavyweights are scrambling. Over 40 major banks, tech firms, and payment processors seek stablecoin licenses. Applications open August 1st under a new city law. Yet regulators expect just a tiny handful to win approval. This creates an intense competition right now. Local Chinese media reports confirm the strong interest.

Random Roger's Retirement Planning

JULY 8, 2025

On Tuesday I sat in on a webinar for the Calamos Autocallable Income ETF (CAIE). Based on the webinar, autocallables are a longstanding and widely used institutional product packaged as a structured note that pays a high income and is usually tied to some sort of reference security, in this case a low volatility version of the S&P 500. CAIE purports to be the first product that makes autocallables available in an ETF so it avoids high minimums and makes it more liquid.

Advertisement

Where are top advisors focusing in 2025? AcquireUp’s 2025 Industry Index reveals it all. Based on insights from 200+ financial professionals nationwide, discover why 74% say seminars and referrals deliver the best ROI, how automation is helping advisors scale faster, and why only 8% are tapping into niche marketing (a major growth opportunity!). Whether you're refining your client acquisition strategy or scaling your practice, this report gives you the real-world data, benchmarks, and action ste

Advisor Perspectives

JULY 8, 2025

Private equity has officially conquered the registered investment advisor (RIA) landscape. It is now responsible for a significant portion of RIA-linked M&A activity.

Trade Brains

JULY 8, 2025

Synopsis- The Bengaluru-based fintech startup Slice has launched its first-ever UPI-powered digital branch, modernizing the banking sector. This fully digital, paperless, “phygital” branch lets you do monetary transactions using UPI and digital kiosks, majorly targeting tech-savvy individuals and students. This move sets the beginning of a significant revolution in the banking services industry in India.

Advisor Perspectives

JULY 8, 2025

We upgrade equities to neutral from underweight as falling interest rates and improving economic conditions in emerging markets offset uncertainty over US tariff policies.

Million Dollar Round Table (MDRT)

JULY 8, 2025

By Antoinette Tuscano, MDRT senior content specialist Working hard and producing high-quality work is nonnegotiable, but unnecessarily working harder won’t score you extra points in life. In fact, it may cause you to burn out and have a serious impact on your mental and physical health. “Efficiency is the cornerstone of a balanced work-life,” said nine-year MDRT member Gareth James Chalk, PFS , in his 2024 MDRT Annual Meeting presentation, “ Revolutionizing efficiency and engagement, AI and auto

Speaker: Cheryl J. Muldrew-McMurtry

Remote finance teams are rewriting how the back-office runs—and attackers are taking notes. Disconnected workflows, process blind spots, and rising cyber threats have become more than just “growing pains”. They’re now liabilities. The challenge isn’t just team distribution, but building resilient systems that protect accuracy, control, and speed across every transaction and touchpoint.

Advisor Perspectives

JULY 8, 2025

Investors attempting to manage volatility in their portfolio often employ defensive equity strategies to define their optimal market exposure and risk profile. Such strategies are designed to help limit losses on the downside, while also allowing investors to participate in the market’s gains.

Trade Brains

JULY 8, 2025

Synopsis- In a move by Kotak Mahindra Bank to consolidate and bring all its credit under the same umbrella and enhance cost effectiveness, the bank has announced to discontinue its Myntra Kotak Credit Card starting from 10 July 2025. Existing cardholders will be migrating to the Kotak League Platinum Credit Card. With this, the bank is trying to achieve its broader goal of consolidating offerings and shifting users toward a more versatile, premium-tier card.

Fintoo

JULY 8, 2025

Market Commentary Global markets – US indices closed mixed on Tuesday after Trump planning to impose 50 pct tariff on import of copper. Dow Jones closed negative by 0.4 pct. While Nasdaq closed flat. Global Indices % Change Last Close 1 day YTD Dow Jones 44,240 -0.4 4.0 Nasdaq 20,418 0.0 5.7 Hang […] The post Market Morning Notes For 9th July 2025 appeared first on Fintoo Blog.

Trade Brains

JULY 8, 2025

Breakout stocks refer to shares of companies that experience a significant price movement after breaking through key technical resistance levels, signaling a potential shift in trend. These stocks often attract investor attention as they break out of consolidation phases, indicating strong bullish momentum. Typically, a breakout occurs when a stock surpasses a previous high or pattern resistance, signaling the start of a new upward trend.

Speaker: Claire Grosjean, Global Finance & Operations Executive

Finance teams are drowning in data—but is it actually helping them spend smarter? Without the right approach, excess spending, inefficiencies, and missed opportunities continue to drain profitability. While analytics offers powerful insights, financial intelligence requires more than just numbers—it takes the right blend of automation, strategy, and human expertise.

Validea

JULY 8, 2025

The investment landscape is in constant flux, requiring sophisticated tools to identify genuine growth opportunities. In 2005, Professor Partha Mohanram developed the G-Score methodology as a structured approach to evaluating growth companies, designed to complement Joseph Piotroski’s F-Score system for value-based investing. This framework analyzes eight specific financial indicators designed for growth-oriented enterprises.

Advisor Perspectives

JULY 8, 2025

Robinhood Markets Inc. Chief Executive Officer Vlad Tenev said the firm is in talks with regulators over its offering of tokenized equities in Europe, after the launch drew rebuke from companies including OpenAI.

Discipline Funds

JULY 8, 2025

Here are some things I think I am thinking about: 1) The Return of ZIRP (zero interest rate policy). The Fed released an interesting study this week saying there was about a 9% chance of the Fed cutting interest rates to 0% again. That’s an interesting one to me because I would say that there’s about a 100% chance the Fed will get back to 0% at some point.

Trade Brains

JULY 8, 2025

Smartworks Coworking Spaces Limited is launching its Initial Public Offering (IPO) to raise funds for business expansion and reduce debts. The issue comprises a fresh issue of 1.09 crore equity shares totaling Rs. 445 crore and an offer for sale of 0.34 crore shares worth Rs. 137.56 crore. The total offer size aggregates up to Rs. 582.56 crore. The IPO opens for subscription on July 10, 2025, and closes on July 14, 2025.

Speaker: David Worrell, CFO, Author & Speaker

Your financial statements hold powerful insights—but are you truly paying attention? Many finance professionals focus on the income statement while overlooking key signals hidden in the balance sheet and cash flow statement. Understanding these numbers can unlock smarter decision-making, uncover risks, and drive long-term success. Join David Worrell, accomplished CFO, finance expert, and author, for an engaging, nontraditional take on reading financial statements.

Let's personalize your content