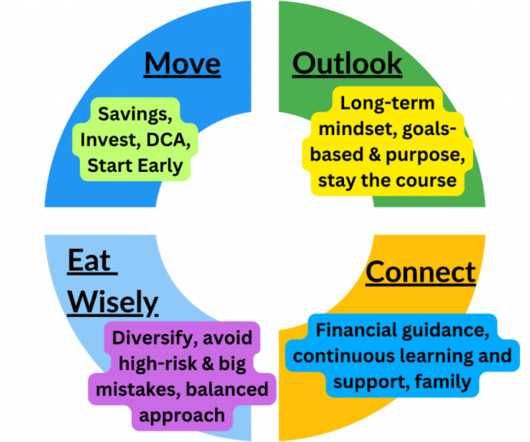

Adviser links: holistic financial guidance

Abnormal Returns

MARCH 13, 2023

Podcasts Mihael Kitces talks the challenges of succession planning with Yonhee Choi Gordon a Principal and the COO of JMG Financial Group. kitces.com) Peter Lazaroff talks SECURE Act 2.0 with Plancorp's Brian King. peterlazaroff.com) Daniel Crosby talks with Eben Burr, who is the President of Toews, about risk management.

Let's personalize your content