Big Beautiful Bill: What Estate-Planning Steps Make Sense Now?

Wealth Management

JULY 9, 2025

Explore how the One Big Beautiful Bill Act impacts estate planning across wealth levels, emphasizing flexibility and income tax strategies for advisors.

This site uses cookies to improve your experience. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country, we will assume you are from the United States. Select your Cookie Settings or view our Privacy Policy and Terms of Use.

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Used for the proper function of the website

Used for monitoring website traffic and interactions

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Estate Planning Related Topics

Estate Planning Related Topics

Wealth Management

JULY 9, 2025

Explore how the One Big Beautiful Bill Act impacts estate planning across wealth levels, emphasizing flexibility and income tax strategies for advisors.

Nerd's Eye View

NOVEMBER 4, 2024

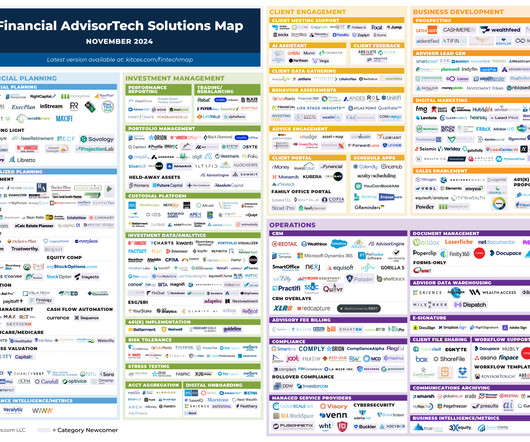

Welcome to the November 2024 issue of the Latest News in Financial #AdvisorTech – where we look at the big news, announcements, and underlying trends and developments that are emerging in the world of technology solutions for financial advisors!

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Wealth Management

MAY 27, 2025

David Handler provides insights into the essential role financial advisors play in estate planning, why it's important to have an estate plan and the importance of communication and education within families about wealth management.

Wealth Management

MAY 19, 2025

Decoding covered gifts and bequests under the final regulations.

Advertisement

This article explores the impact of medical/LTC expenses on estate planning objectives, and discusses strategies to keep assets flexible to address needs that may arise while satisfying the objective of transferring wealth to designated beneficiaries.

Wealth Management

OCTOBER 17, 2024

Have more productive estate plan meetings.

Wealth Management

NOVEMBER 19, 2024

Clients increasingly view estate planning as a core element of holistic wealth management, not just a one-time task, according to a survey from online estate planning platform Vanilla.

Wealth Management

NOVEMBER 19, 2024

Clients increasingly view estate planning as a core element of holistic wealth management, not just a one-time task, according to a survey from online estate planning platform Vanilla.

Wealth Management

MARCH 18, 2024

Estate planning is far more than a legal formality for business owners, art collectors and aging clients.

Wealth Management

AUGUST 12, 2024

Estate planning and financial planning are two peas in a pod that are becoming inextricably tied.

Wealth Management

NOVEMBER 3, 2024

Step-by-step guide for better estate plan conversations.

Wealth Management

MARCH 13, 2024

Will you be there to help clients with wills, trusts and estate planning needs?

Wealth Management

NOVEMBER 19, 2024

Prepare for the future with expert insights — explore the latest findings on trust and estate planning trends in 2024.

Wealth Management

NOVEMBER 10, 2024

A detailed glossary of estate planning terminology.

Wealth Management

APRIL 23, 2025

Essential estate planning strategies for volatile markets, including GRATs, charitable trusts, and QPRTs. Learn how to optimize wealth transfer and minimize tax impact during high interest rates and market uncertainty.

Wealth Management

JANUARY 11, 2024

Two fellowship participants share their experiences in the estate planning field.

Wealth Management

FEBRUARY 8, 2024

EncorEstate Plans has created a solution that allows the advisor to collaborate with the client throughout the estate planning process.

Wealth Management

FEBRUARY 13, 2025

At its core, estate planning is about deep, enduring lovethe kind that extends beyond Valentine's Day, a single day of chocolates and roses

Wealth Management

JANUARY 15, 2025

The right estate planning approach can result in a significant, tax-efficient transfer of your clients wealth.

Wealth Management

JUNE 12, 2024

Trust & Will's Andrew Mazabel discusses what's at stake for advisors that don't offer estate planning as a service.

Wealth Management

JANUARY 27, 2025

Estate planning isnt just for the ultra-wealthy.

Wealth Management

FEBRUARY 26, 2024

With the news of King Charles' cancer diagnosis, we re-present this episode exploring how estate plans work when there are international heirs involved.

Wealth Management

JANUARY 3, 2024

Take this quiz to find out if you understand the key strategies and techniques used by estate-planning practitioners

Wealth Management

APRIL 3, 2025

As client expectations evolve, estate planning is no longer an afterthought for financial advisors.

Wealth Management

JUNE 5, 2023

The likelihood that the client does not have good title to artwork should be taken into consideration when creating an estate plan.

Wealth Management

JUNE 27, 2025

Sponsored Content Alternative Investments Summit: Navigating the New Frontier Alternative Investments Summit: Navigating the New Frontier Apr 11, 2025 Matt Magill KKR Alternative Investments RIAs and the Evolving Landscape of Private Wealth RIAs and the Evolving Landscape of Private Wealth by WealthManagement.com Staff Jun 27, 2025 Wealth Planning (..)

Nerd's Eye View

APRIL 5, 2023

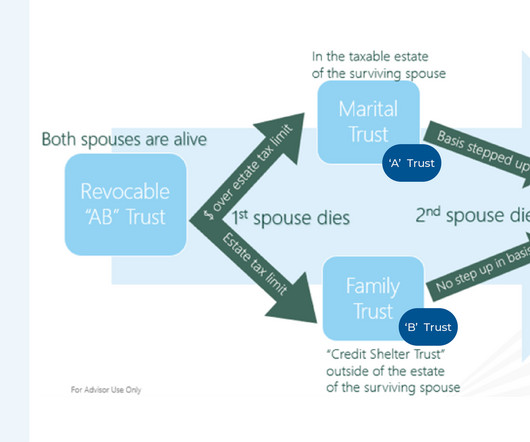

In recent years, the Internal Revenue Code (IRC) has endured some drastic changes resulting from legislative action that have altered the strategies estate planning professionals have recommended to clients.

Wealth Management

APRIL 29, 2024

Vanilla co-founder Steve Lockshin details the nuances surrounding NIL deals and the foundational estate planning strategies every individual, regardless of fame, should consider.

Wealth Management

JULY 1, 2025

Sponsored Content Alternative Investments Summit: Navigating the New Frontier Alternative Investments Summit: Navigating the New Frontier Apr 11, 2025 Stock market chart data silhouette Investing Strategies The Promise of Direct Indexing—And the Disconnect Holding It Back The Promise of Direct Indexing—And the Disconnect Holding It Back by Don Cody (..)

Wealth Management

JULY 2, 2025

Sponsored Content Alternative Investments Summit: Navigating the New Frontier Alternative Investments Summit: Navigating the New Frontier Apr 11, 2025 Cetera alternative investments Alternative Investments Cetera Launches First in a Planned Line of Alternative Investments Models Cetera Launches First in a Planned Line of Alternative Investments Models (..)

Wealth Management

JULY 2, 2025

They are also less likely to benefit from pension plans than their parents were, while 401 (k) plans were still not as widespread as they are today when this generation entered the workforce. trillion annually over the next decade as part of the great wealth transfer, a new report finds.

Wealth Management

JUNE 26, 2025

Jun 20, 2025 Sign Up for Newsletters Sign up to receive the latest insights, trends, and analysis.

Wealth Management

SEPTEMBER 7, 2023

Twenty points to help ensure your clients' legacies stay on track.

Wealth Management

JUNE 5, 2024

The problem and opportunity for financial advisors when it comes to estate planning are immense, but who’s on your side?

Wealth Management

NOVEMBER 10, 2023

What if a client burdened with substantial debts or liabilities from their business unexpectedly passes away?

Wealth Management

APRIL 29, 2024

Vanilla co-founder Steve Lockshin details the nuances surrounding NIL deals and the foundational estate planning strategies every individual, regardless of fame, should consider.

Wealth Management

JULY 8, 2025

Sponsored Content Alternative Investments Summit: Navigating the New Frontier Alternative Investments Summit: Navigating the New Frontier Apr 11, 2025 Charles Schwab bank branch Mutual Funds Schwab Expands Roster of No Transaction Fee Mutual Funds Schwab Expands Roster of No Transaction Fee Mutual Funds by David Bodamer Jul 8, 2025 1 Min Read Wealth (..)

Wealth Management

OCTOBER 2, 2024

Five ways to turn potential tax scares into sweet savings.

Wealth Management

JUNE 5, 2024

The problem and opportunity for financial advisors when it comes to estate planning are immense, but who’s on your side?

Wealth Management

JUNE 26, 2025

Sponsored Content Alternative Investments Summit: Navigating the New Frontier Alternative Investments Summit: Navigating the New Frontier Apr 11, 2025 Carlyle Group Alternative Investments Carlyle Makes New Retail Fund Push to Buy and Sell PE Stakes Carlyle Makes New Retail Fund Push to Buy and Sell PE Stakes by Dawn Lim Jun 26, 2025 2 Min Read Wealth (..)

Wealth Management

MAY 27, 2025

Advisor and author George Stefanou details the estate planning challenges faced by first-generation millionaires, drawing insights from boxer Leon Spinks' financial journey and legacy.

Wealth Management

JUNE 4, 2025

Billionaire David Geffen files for divorce from David Armstrong after less than two years, revealing how estate planning can safeguard wealth.

Wealth Management

FEBRUARY 5, 2024

For advisors and estate planners working impulsive clients, it is important to distinguish between risky behavior and sub-optimal decision-making.

Nerd's Eye View

FEBRUARY 26, 2025

To achieve this, financial support may start at a very young age, allowing for a longer growth horizon and, in many cases, serving tax and estate planning purposes. Parents often want to ensure their children have the resources to pursue their potential and lead fulfilling lives. Read More.

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content