Most investors would probably like to move on and forget about 2022 when it comes to market performance. It was an all-time bad year for the markets. But there were some valuable lessons in the carnage.

You learn more about yourself during a bear market than a bull market.

This piece I wrote at Fortune delves into 5 lessons for investors from 2022.

*******

Last year was one of the worst for financial markets in modern economic history. Stocks went into a bear market. Bonds, typically a bastion in a storm for equities, also got hit hard.

It was not an easy year for investors, because there was nowhere to hide.

Let’s look at some of the biggest lessons from the year that was in 2022:

Anything can happen in the short run

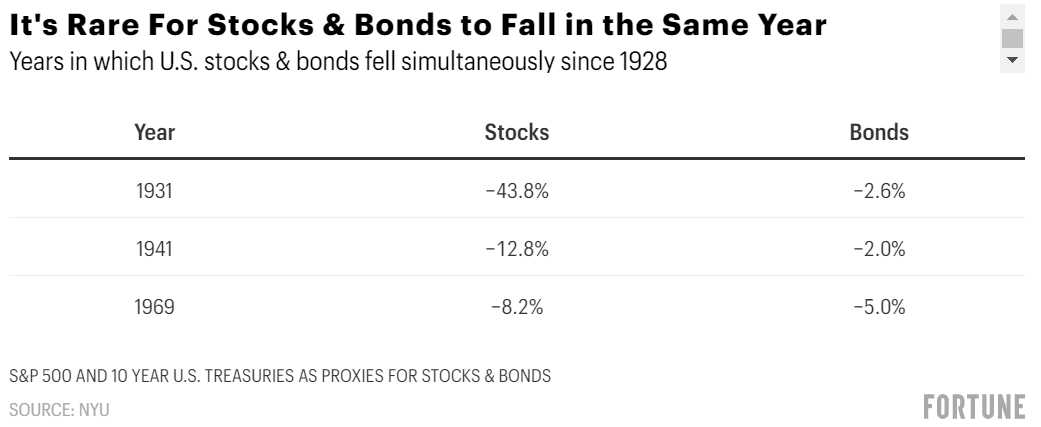

It’s rare for U.S. stocks and bonds to be down in the same year at the same time. In fact, it’s only happened three times since 1928 before 2022:

Typically, when the stock market falls, bonds provide the ballast to your portfolio as investors rush into the safety of fixed income.

Last year, however, the decline in stocks happened in part because of what’s been going on in the bond market. The Fed aggressively raised interest rates to help fight the highest inflation in four decades.

Since bonds were starting from such a low yield, the losses have been larger than anything investors have seen in modern financial market history.

The U.S. stock market fell a little more than 18% in 2022, while the aggregate U.S. bond market was down 13%. Ten-year Treasuries were down more than 15%, while long-term government bonds crashed more than 30%.

So this was not only the first time in decades that both stocks and bonds were down in the same year, but it’s the first time in history that stocks and bonds were each down double-digits in the same year. There is a good case to be made that 2022 was one of the worst years performance-wise for traditional stock and bond portfolios ever.

Last year is a good reminder that anything can happen in the short term when it comes to the markets, even stuff that’s never happened before.

Predicting the future is hard

The U.S. housing market came into 2022 scorching hot. The Case-Shiller National Home Price Index was up nearly 20% year over year by the end of 2021.

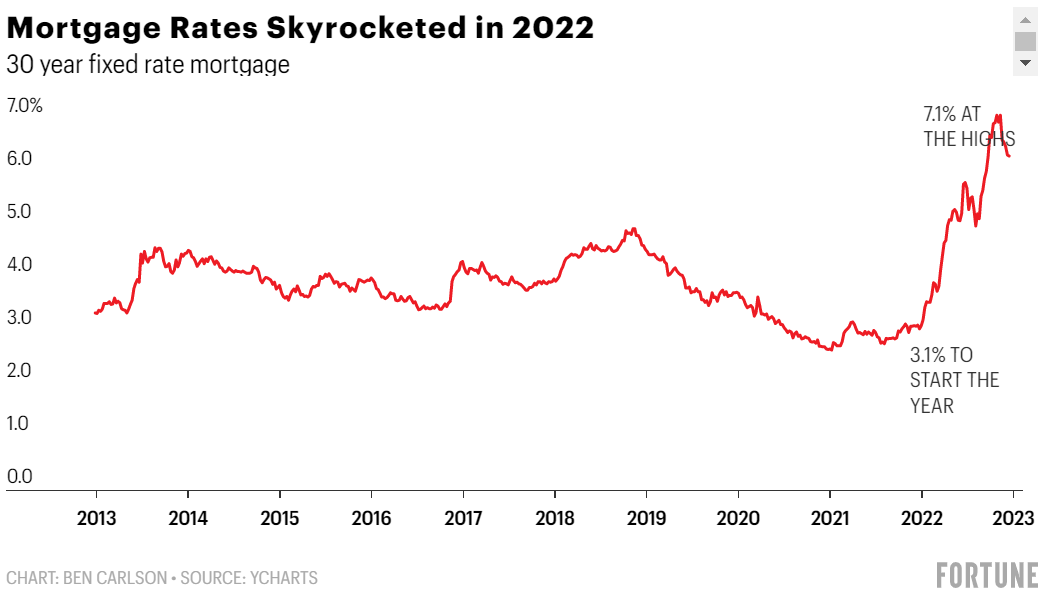

One of the biggest reasons for the housing price boom was the ultralow interest rate environment that came about because of the pandemic. Coming into the year, mortgage rates for a 30-year fixed-rate loan were still just 3.1%. That didn’t last long.

Mortgage rates more than doubled in 2022, reaching upwards of 7.1% for the national average before ending the year at around 6.4%.

There were people predicting the housing market would take a much-needed breather last year, but absolutely no one was forecasting mortgage rates would get so high in such a short period of time.

Housing prices are finally starting to roll over in large part because of this massive move higher in mortgage rates.

Last year is a good reminder that price forecasts are often impacted by economic and market variables most people cannot possibly predict in advance.

Nothing works forever

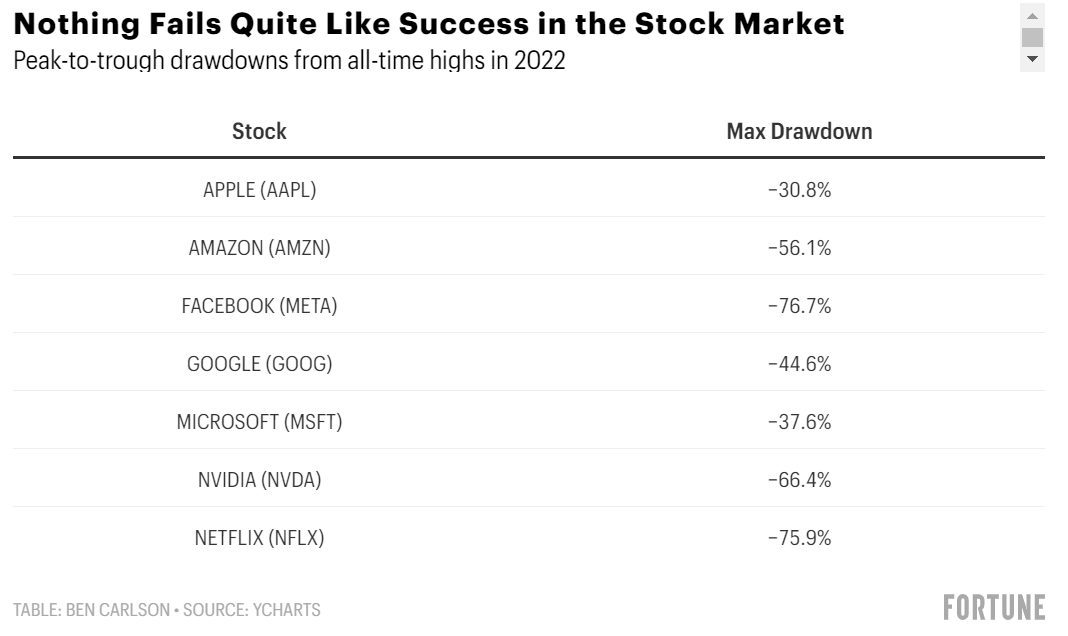

Technology stocks were the big winners of the 2010s. Companies like Apple, Amazon, Microsoft, Facebook, and Google became so big and dominant that they were beginning to feel like one-decision stocks—and that decision was to buy them.

There’s an old saying that nothing fails quite like success on Wall Street because expectations soar so high that it becomes nearly impossible to continue outperforming what investors think will happen in the future.

Technology stocks finally experienced what it was like to deal with such lofty expectations in 2022. These were the peak-to-trough drawdowns from all-time highs for some of the biggest tech stocks in 2022:

These are some of the biggest and best companies on the planet, but stock prices can only go so high before gravity kicks in.

Last year is a good reminder that even the best companies can lead to big losses at the wrong price.

Big gains are typically accompanied by big losses

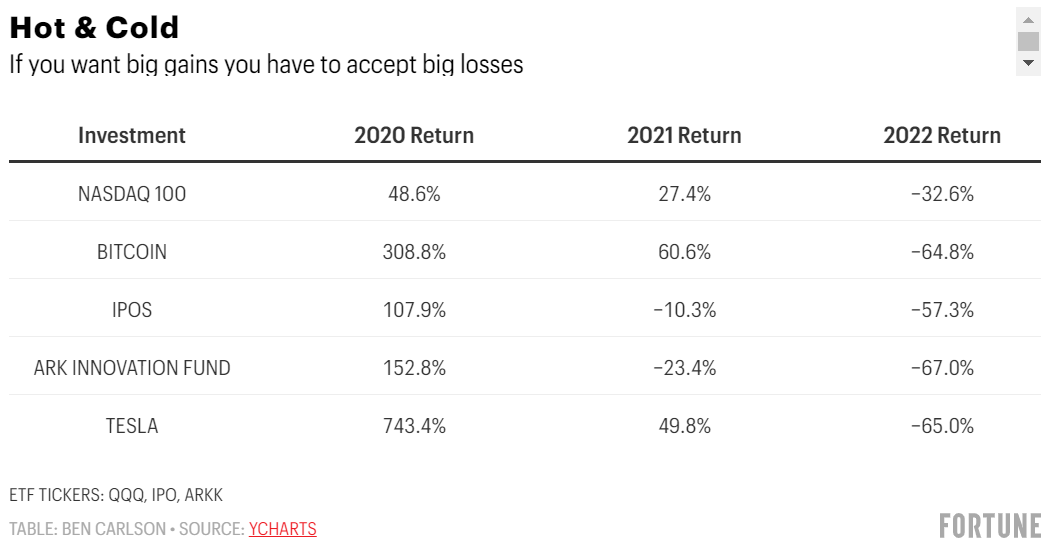

The pandemic boom times saw a number of assets and securities take off like a rocket ship with massive gains. Investors bid up a number of speculative investments in 2020 and early 2021.

Many of those rocket ships came back to earth in late 2021 and 2022:

The best performers of the boom times are often the worst performers of the bust times, and the past few years were no different.

Last year is a good reminder that you cannot earn outsize returns in the financial markets without the potential for outsize losses.

Losses in the markets are inevitable

Last year was one of the worst on record in the stock market, but those losses make a lot more sense when you view them in the context of the gains that preceded them.

In the three years before last year’s 18% loss in the S&P 500, the index was up 31%, 18%, and 28%. Even with large losses in 2022, the S&P 500 is still up well over 60% in total since 2019. That’s good enough for 13% returns per year.

Last year is a good reminder that downturns are never fun to deal with in the moment, but if you are able to zoom out and keep a long-term mindset, eventually the gains outweigh the losses.

This piece was originally published at Fortune.