Economic theory posits that when left to their own devices, markets achieve a reasonably efficient allocation of scarce goods except when there are externalities(1), such as from pollution and carbon emissions that affect the climate. Economists know there is a simple solution to address carbon externalities: a carbon tax. In the absence of such a tax, an interesting question is: Are financial markets addressing the externalities through environmental, social and governance (ESG) investment strategies and thus asset allocation?

Patrick Bolton, Zachery Halem, and Marcin Kacperczyk contribute to the sustainable investing literature with their May 2022 study, “The Financial Cost of Carbon.” Their focus was:

“attempting to discern or reveal the links between stock returns, corporate valuations by financial markets, and corporate carbon emissions.”

They began by noting:

“Climate finance must be seen first and foremost as a response to a risk-management problem, a response by companies and their investors to the mounting financial risks associated with climate change and the transition to a net zero economy.”

They added:

“For investors, taking account of climate risk exposure means essentially three things. First, prudent investors will seek to hedge climate change risk by reducing their exposure to it. Second, investors will demand compensation for holding this risk. Third, investors will engage with companies to exert pressure on them to reduce this risk if they are not adequately compensated for it. Reducing exposure to carbon transition risk—a form of divestment—can be justified purely based on effective, long-run value-maximizing risk management.”

Following is a summary of their findings:

- Carbon transition risk is becoming increasingly material and is priced both in equity and debt markets.

- The carbon premium is present in all industry sectors, not just the energy, utility, and transport sectors where most divestment has occurred.

- The largest companies tend to have the biggest discounts and therefore stand to benefit the most in terms of valuation impacts from emissions reductions (further pronounced at the sector level).

- There is a widespread price-earnings discount (investors demand compensation for incremental risks) linked to corporate carbon emissions, which varies by sector and trends differently in Europe than in the U.S.

- A small discount emerges for corporate bonds, although it was statistically significant only for small caps.

- Companies with greater exposure to climate change-related risk have a higher cost of capital, resulting in both lower price multiples on their projected earnings stream and higher hurdle rates on new investment—which should prompt their business and industry to shrink.

- Over the period 2005-2019, across almost all 77 countries studied, both direct (scope 1) and indirect (scope 2 and 3) lagged carbon emissions had a positive association with stock returns after controlling for all other risk factors and companies’ characteristics that were expected to influence stock returns. Companies with higher levels of carbon emissions, or higher growth rates in emissions, tend to have higher stock returns, holding other things equal, as a result of investors demanding risk premiums (in this case a carbon premium). For example, a one-standard-deviation increase in scope 1 emissions was associated with a 13% lower market-to-book ratio.

- The most eye-catching difference between U.S. and European carbon discounts was the one now being applied to large market cap European industrials—while there was a fairly modest discount rate of 0.5% for U.S.-based industrials, it was close to 18% for large-cap European industrials! Thus, a high emitter trading at a price-to-earnings multiple of 17 could expect to see its low-emissions competitors trading as high as 20 times earnings—a significant competitive advantage (which should drive corporate behavior). Note that the period studied coincides with the launch of the European Union’s carbon cap-and-trade system (EU ETS). By contrast, the U.S. has no mandatory national scheme.

- The positive relation between stock returns and the level of emissions reported held when returns were linked to lagged emissions and after controlling for firm size, sales growth, and return on equity.

- It is the differences among companies within an industry—and not the differences across industries—that are driving results, providing striking evidence of carbon premiums for companies with high emissions operating in the same industry. (Note: This could reflect a “best-in-class” approach to sustainable investment strategies versus a negative screening approach.)

- There is evidence that the pricing discount also emerges, albeit to a smaller extent, for other greenhouse gas emissions (such as methane, nitrous oxide, and hydrofluorocarbon emissions).

Bolton, Halem, and Kacperczyk did note that over the very recent period, there has been a “greenium,” with green stocks outperforming brown stocks. However, this finding of an ex-post greenium, despite ex-ante expectations of a brown premium, was caused by a shifting equilibrium. As explained by the authors of the 2021 study “Dynamic ESG Equilibrium,” despite investor preferences for sustainable investments creating a brown premium of about 1% per year, over the period 2018-2020 the increased demand for sustainable investments led to a green portfolio outperforming by about 7 percentage points a year (14% versus 7%). However, the long-term effect is that the higher valuations reduce expected long-term returns. The result can be an increase in green asset returns even though brown assets earn higher expected returns. In other words, there can be an ambiguous relationship between sustainable risks and returns in the short term. These conflicting forces, along with the difficulties created by the dispersion in sustainability ratings by the various providers, can create challenges for investors in interpreting the findings from academic papers. It is also worth noting that all the challenges are not related to ESG issues. For example, the advent of fracking led to a swelling of oil and gas supply, which affected prices and returns, and Covid had a dramatic impact on segments of the market, such as airlines and hotels as well as industrials.

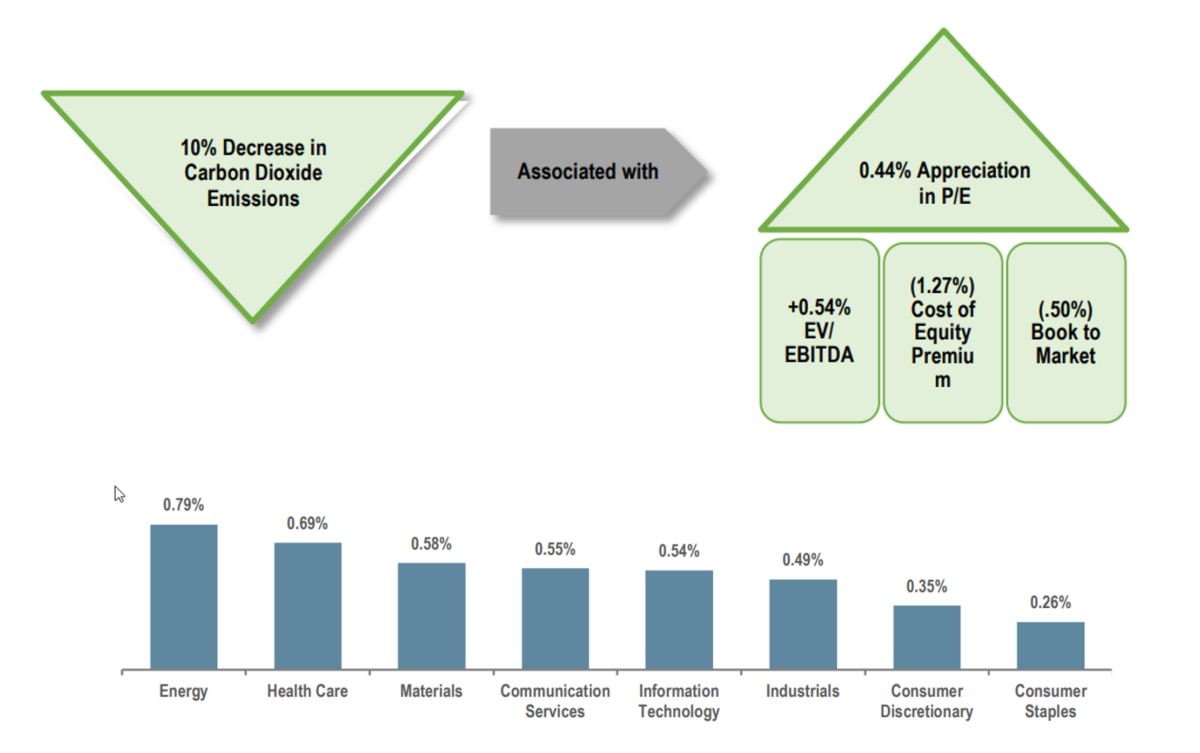

In their analysis of the period 2016-2020 (when ESG strategies began to receive huge cash inflows), Bolton, Halem, and Kacperczyk found that a 10% reduction in a company’s carbon emissions (note that the Paris Accords call for much greater reductions) would have resulted in a 0.44% increase, on average, in its price-earnings ratio (it was 0.79% in the energy sector versus 0.26% in consumer staples), a 0.54% increase in its enterprise multiple (enterprise value divided by earnings before interest, taxes, depreciation and amortization) and a 0.50% increase in its market-to-book ratio. Clearly, the rise in relative valuations of high-ESG-scoring companies reflects the fact that the level of carbon emissions has had a significant and increasingly negative impact on price-to-earnings ratios, reflecting a price discount that investors are now requiring to bear the higher carbon transition risk exposure of their portfolio companies as political and regulatory risk become ever more salient.

Regarding the impact of carbon risk, Bolton, Halem, and Kacperczyk observed:

“Lower valuations and higher investment hurdle rates should, especially with prodding from value-maximizing activist shareholders, exert pressure on managements to reduce their carbon transition risk exposure by committing to gradual decarbonizing of their operations and by disclosing their emissions.”

Their findings on risk are supported by empirical research on the subject. For example, Guido Giese, Linda-Eling Lee, Dimitris Melas, Zoltán Nagy, and Laura Nishikawa, authors of the 2019 study “Foundations of ESG Investing: How ESG Affects Equity Valuation, Risk, and Performance,” found that firms with high ESG scores had better risk management and better compliance standards, leading to fewer extreme events such as fraud, corruption, and litigation (and their negative consequences). The result was a reduction in tail risk in high-ESG-scoring firms relative to the lowest ESG-scoring firms. The highest scoring ESG firms also had lower idiosyncratic risk. They also found that high-ESG-scoring firms had less exposure to market shocks and exhibited lower recent five-year volatility of earnings when compared to low-scoring firms. Thus, they had lower betas. The lower betas resulted in higher valuations (such as lower book-to-market and higher price-to-earnings ratios), producing lower costs of capital and ultimately lower expected returns. Their findings provide a clear risk-based rationale for why green stocks should have lower expected returns than brown, or “sin,” stocks. A taste-based explanation is provided by the screening process employed by sustainable investors that drives green stocks to have higher valuations and thus lower expected returns.

Investor Takeaways

As Bolton, Halem and Kacperczyk noted:

“Financial markets have begun to respond to climate change and the transition to Net Zero in the way one would expect. Driven by investor beliefs about the impact of climate change on corporations, markets are beginning to price a new and increasing aggregate risk.”

The emergence of a carbon premium reflects financial markets’ pricing risk in such a way that provides investors with a higher return as compensation for bearing higher risk. The result is that the increased popularity of sustainable investment strategies has led to changes in cash flows—raising the cost of capital for companies with poor ESG scores and lowering it for companies with good ESG scores. That has led to changes in the behavior of corporations, increasing their engagement in corporate social responsibility (CSR) as they seek lower costs of capital or face a competitive disadvantage. In addition, companies are seeking to reduce the risks of negative events that lead to heightened risks of lawsuits (e.g., over environmental incidents and discrimination) and consumer boycotts. Companies have also recognized that “doing good” not only improves their reputation but leads to attracting employees who desire to work for companies acting responsibly, enhancing employee satisfaction and, in turn, productivity—and the profitability of the company. Those behaviors are leading to positive feedback loops.

Disclosures

For informational and educational purposes only and should not be construed as specific investment, accounting, legal or tax advice. Certain information is based upon third-party data which may become outdated or otherwise superseded without notice. Third party information is deemed to be reliable, but its accuracy and completeness cannot be guaranteed. By clicking on any of the links above, you acknowledge that they are solely for your convenience, and do not necessarily imply any affiliations, sponsorships, endorsements or representations whatsoever by us regarding third-party websites. We are not responsible for the content, availability or privacy policies of these sites, and shall not be responsible or liable for any information, opinions, advice, products or services available on or through them. The opinions expressed by featured authors are their own and may not accurately reflect those of Buckingham Strategic Wealth® or Buckingham Strategic Partners®, collectively Buckingham Wealth Partners. Neither the Securities and Exchange Commission (SEC) nor any other federal or state agency have approved, determined the accuracy, or confirmed the adequacy of this document. LSR-22-313

About the Author: Larry Swedroe

—

Important Disclosures

For informational and educational purposes only and should not be construed as specific investment, accounting, legal, or tax advice. Certain information is deemed to be reliable, but its accuracy and completeness cannot be guaranteed. Third party information may become outdated or otherwise superseded without notice. Neither the Securities and Exchange Commission (SEC) nor any other federal or state agency has approved, determined the accuracy, or confirmed the adequacy of this article.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Alpha Architect, its affiliates or its employees. Our full disclosures are available here. Definitions of common statistics used in our analysis are available here (towards the bottom).

Join thousands of other readers and subscribe to our blog.