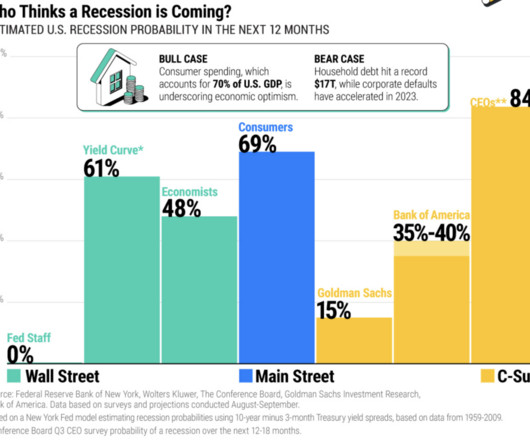

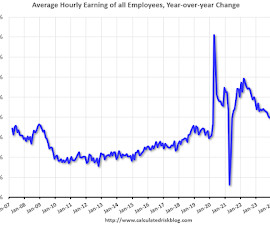

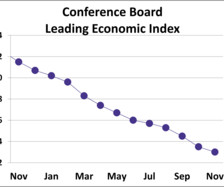

Market Commentary: Things You Don’t See in a Recession

Carson Wealth

DECEMBER 11, 2023

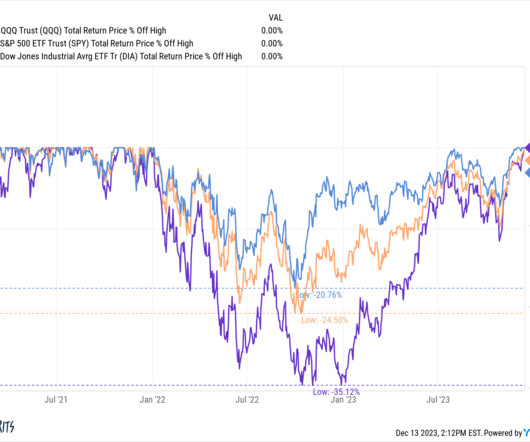

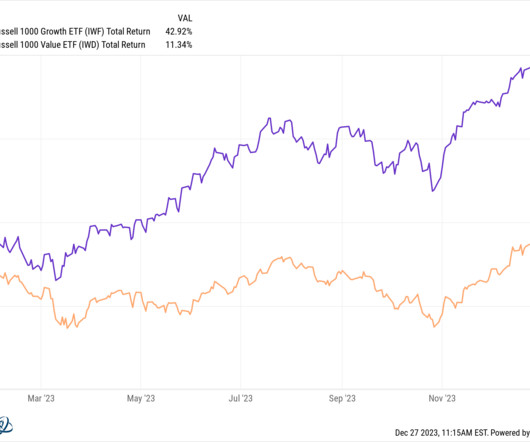

Stocks Remain Strong Stocks took a break last week, which was perfectly normal after a five-week win streak coming off the late-October lows. It is important to remember that stocks lead the economy, both on the way up and the way down. Various indexes are closing in on new all-time highs, and one of the most important indexes in the world is already there.

Let's personalize your content