Podcast links: fake podcast invites

Abnormal Returns

APRIL 26, 2024

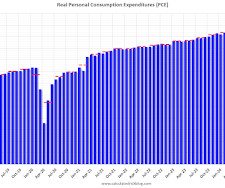

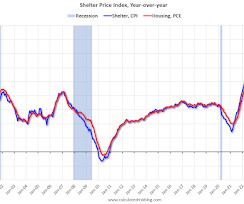

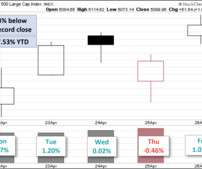

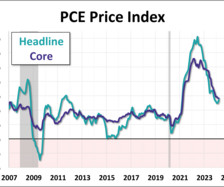

The biz Beware the fake podcast invite. (bigtechnology.com) The Apple ($AAPL)-Spotify ($SPOT) battle is just exhausting. (spyglass.org) Economy Barry Ritholtz talks with Bill McBride about which economic data really matters. (ritholtz.com) James Pethokoukis talks economic optimism with Ed Yardeni. (fasterplease.substack.com) Derek Thompson talks with Ravi Agrawal, the editor-in-chief of Foreign Policy magazine, about India under Modi.

Let's personalize your content