Top clicks this week on Abnormal Returns

Abnormal Returns

MAY 5, 2024

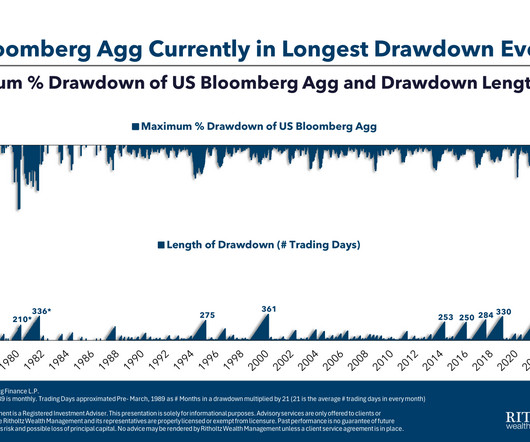

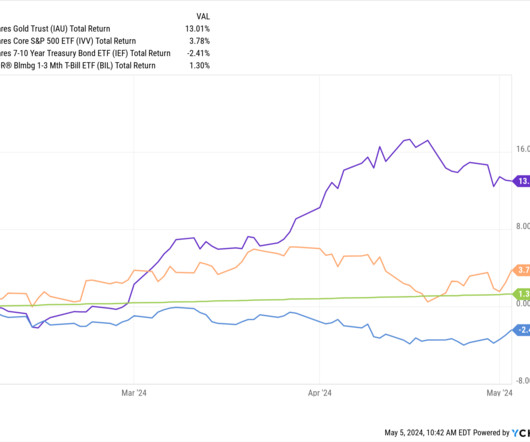

Top clicks this week Widen your investing lens. (awealthofcommonsense.com) Why the stock market usually goes up. (humbledollar.com) The best investors are running their own race. (klementoninvesting.substack.com) How stocks, bonds and cash have performed over the past 30 years. (awealthofcommonsense.com) How major asset classes performed in April 2024.

Let's personalize your content