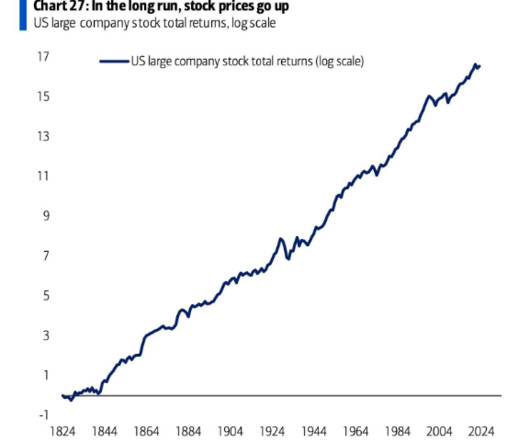

4 Charts That Explain the Stock Market

A Wealth of Common Sense

NOVEMBER 17, 2023

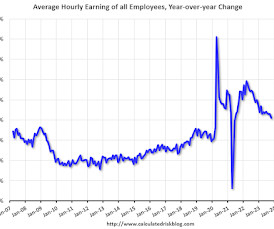

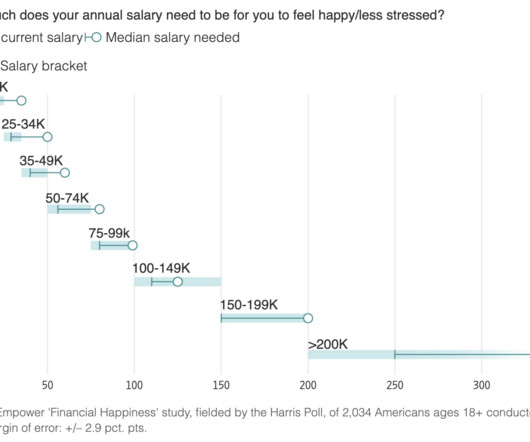

I saw a chart this week from Bank of America that more or less sums up my entire investment philosophy: In the long run, stock prices go up. I view the stock market as a way to invest in innovation, profits, progress and people waking up in the morning looking to better their current situation. While I love the fact that this chart illustrates my long-term philosophy it’s a bit misleading.

Let's personalize your content