Assessing Payouts And Platform Fees For Profitability When Choosing An Independent Advisor Platform To Affiliate With

Nerd's Eye View

APRIL 22, 2024

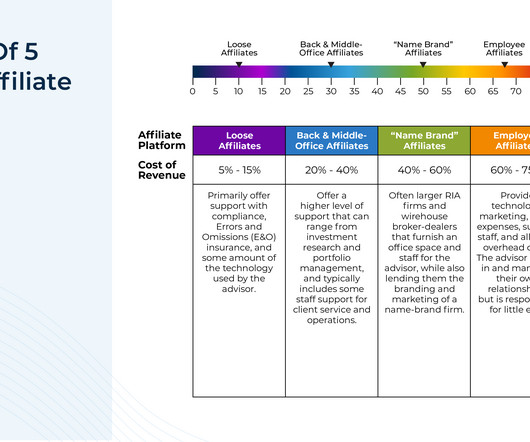

Broadly speaking, there are 2 models of working as a financial advisor: operating independently as a firm owner or with a large affiliate platform such as a wirehouse broker-dealer, independent broker-dealer, or larger corporate RIA. Deciding which model to work under is a key moment in beginning or evolving a career as an advisor. In the independent model, owners/advisors are generally paid directly by the clients they serve, and they select and pay for the vendors, services, and employees that

Let's personalize your content