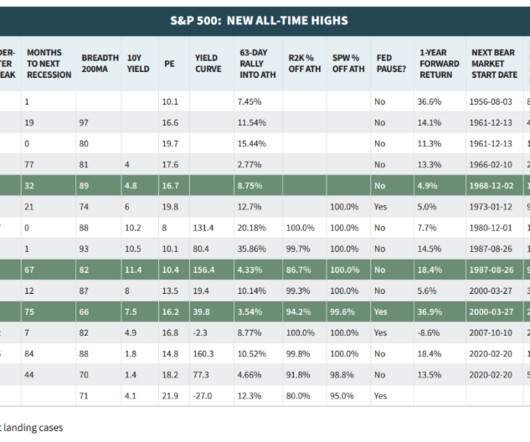

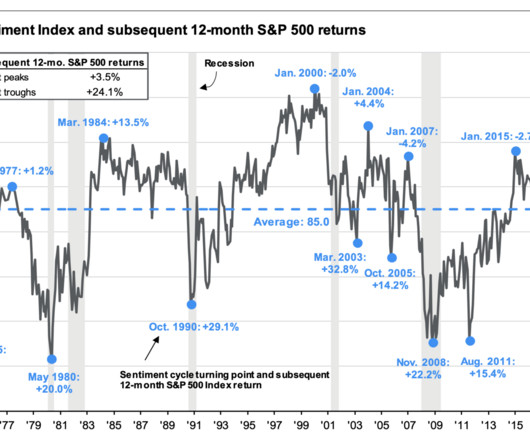

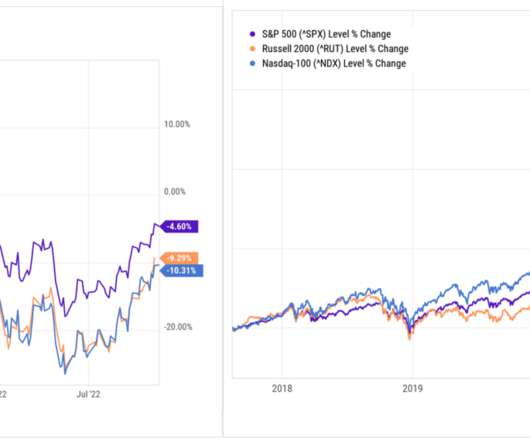

All-Time Highs Are Historically Bullish

The Big Picture

FEBRUARY 22, 2024

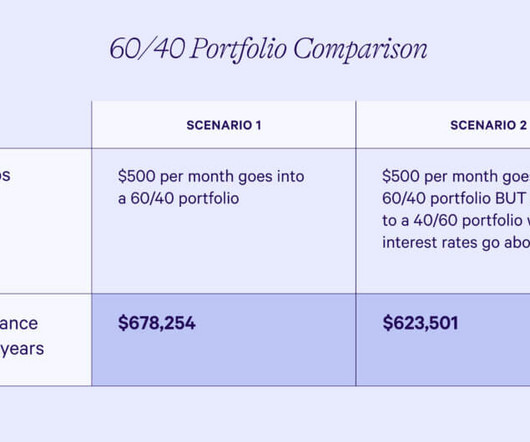

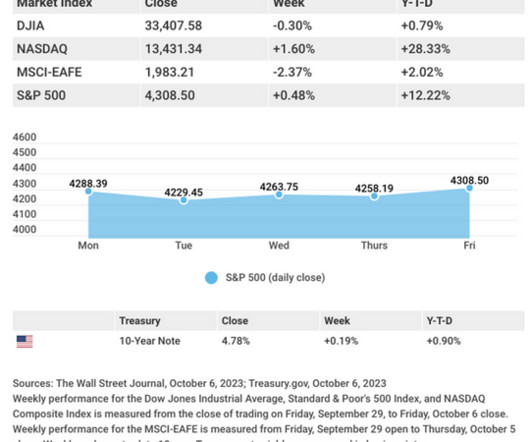

Going back to 1954, markets are always higher one year later – the only exception was 2007. Ask yourself this: Is 2024 more akin to 2007, or most other markets where new all-time highs were made? Check out the table above, via Warren Pies. He spoke with Batnick and Josh earlier this month.

Let's personalize your content