Weekly Market Insights – October 23, 2023

Cornerstone Financial Advisory

OCTOBER 23, 2023

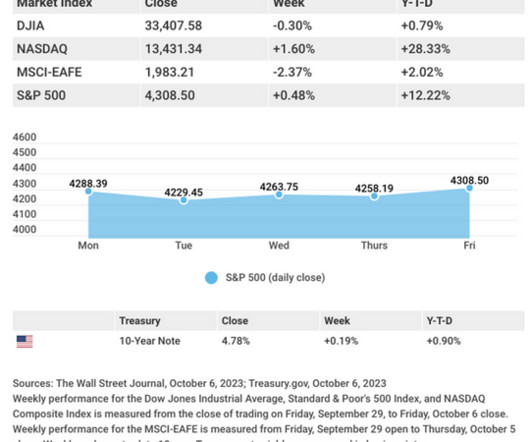

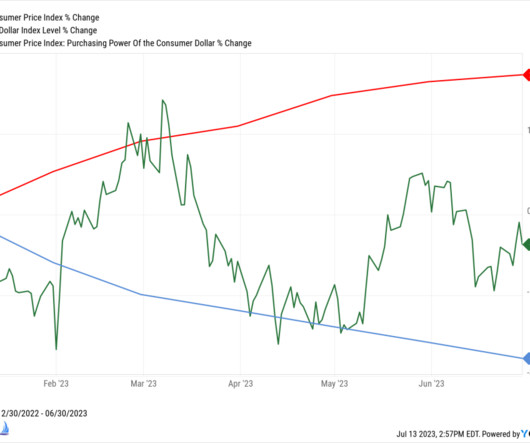

Yields rose after traders speculated that strong economic data might persuade the Fed to raise rates. for the first time since 2007, while mortgage rates hit 8%–the highest level since mid-2000. Economic Strength, Housing Weakness The economy continued to evidence surprising strength according to data released last week.

Let's personalize your content