Sunday links: selling a product

Abnormal Returns

MAY 12, 2024

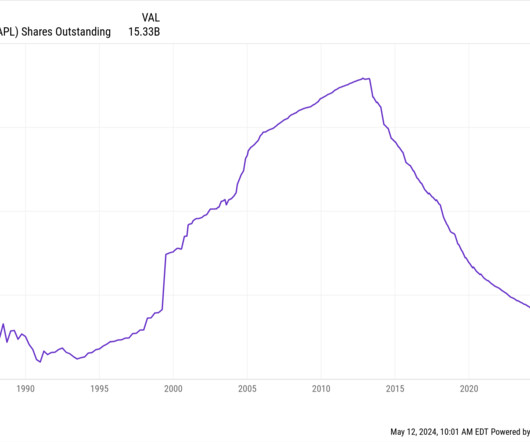

Markets No news is good news for the stock market. (tker.co) The stock market has gone nowhere the past 10 weeks. (allstarcharts.com) What Wall Street jargon really means. (awealthofcommonsense.com) Companies Apple ($AAPL) is now taking AI seriously. (nytimes.com) Adobe ($ADBE) is walking a fine line when it comes to AI. (theatlantic.com) Funds Mutual funds just keep closing.

Let's personalize your content