Market Commentary: Stocks Are Quite Resilient

Carson Wealth

MARCH 27, 2023

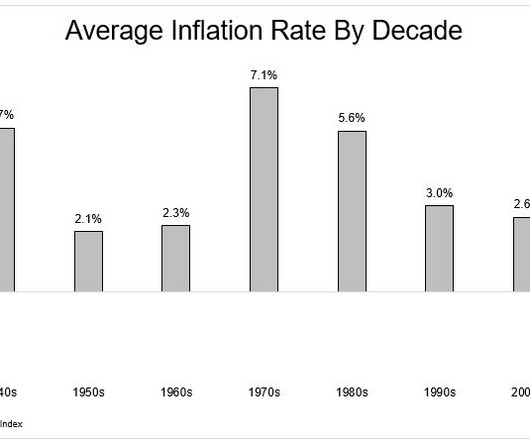

There are certainly more questions than answers right now, and yes, the odds of a recession have increased as banks will tighten lending, which could lead to an economic slowdown. Still, economic data is improving. This is the ninth straight rate increase and brings rates to their highest level since 2007.

Let's personalize your content