Clients rethink Social Security plans amid uncertain environment

Nationwide Financial

JULY 20, 2022

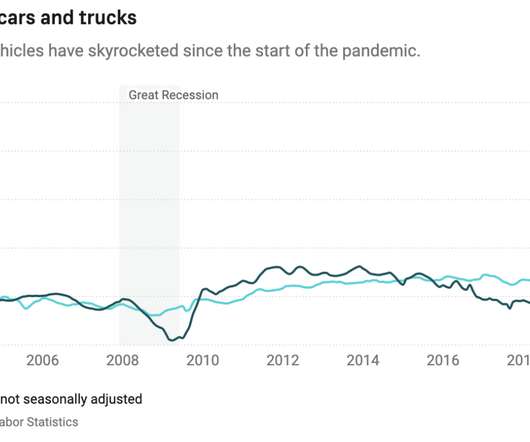

Social Security planning is an important part of preparing for retirement, and clients considering filing for benefits in today’s environment are finding planning more challenging as they contend with the lingering economic impacts of COVID-19, record inflation, and heightened market volatility. How planning has changed?

Let's personalize your content