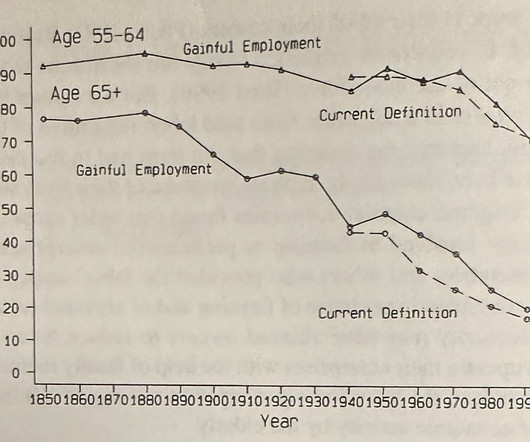

The Evolution of Retirement

A Wealth of Common Sense

AUGUST 29, 2023

There’s a great scene in Midnight in Paris about nostalgia that I think about a lot: Some people always think the past is better than the present because of this golden age line of thinking. I always see memes like this going around Twitter: Life would be better is this was true. Unfortunately, it’s not (see here and here).

Let's personalize your content