Harnessing Volatility Targeting in Multi-Asset Portfolios

Advisor Perspectives

JANUARY 26, 2024

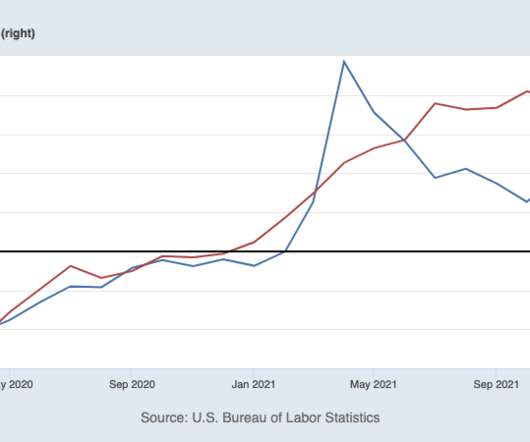

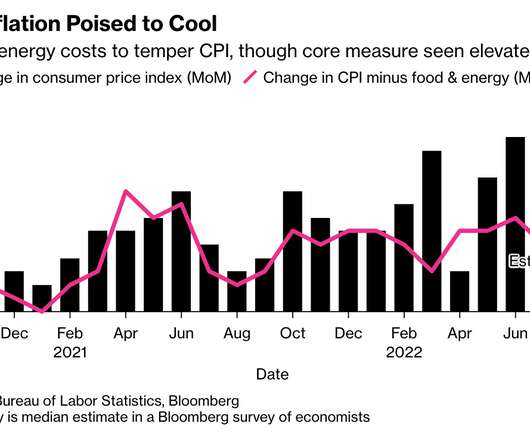

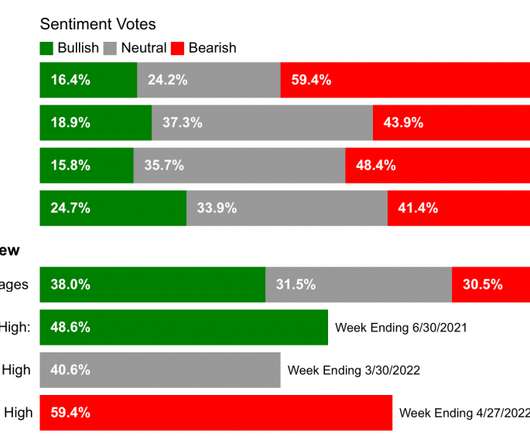

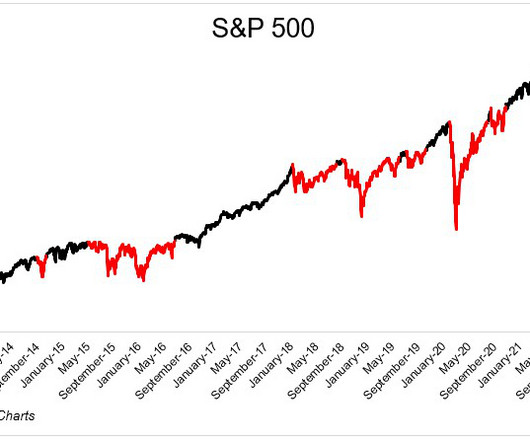

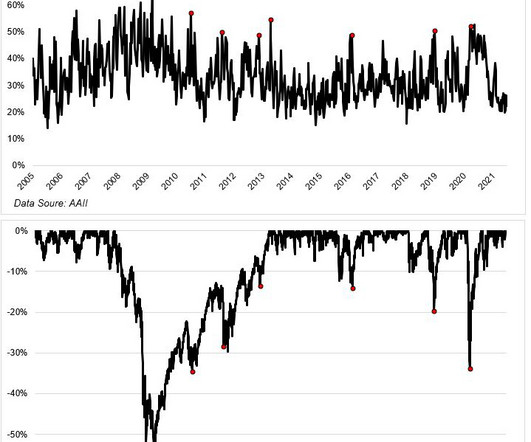

Following a period of relatively calm asset markets from 2013-2019, in which the CBOE Volatility Index (VIX) averaged just below 15, volatility in asset markets has returned 1 and investors have been looking for ways to protect themselves.

Let's personalize your content