Underperforming Your Own Assets

The Big Picture

JULY 25, 2023

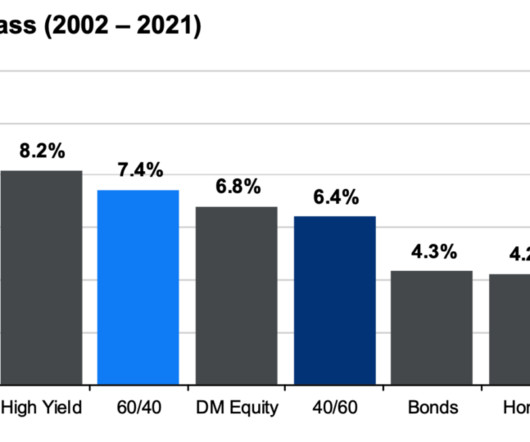

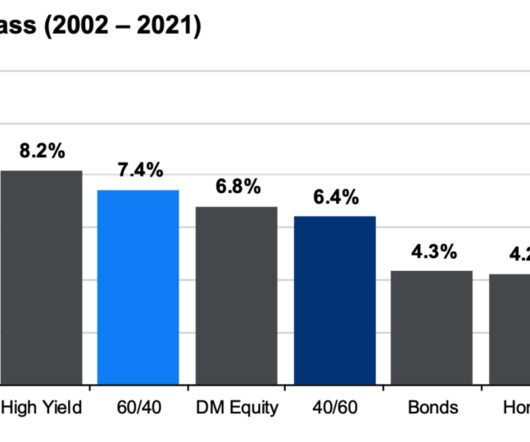

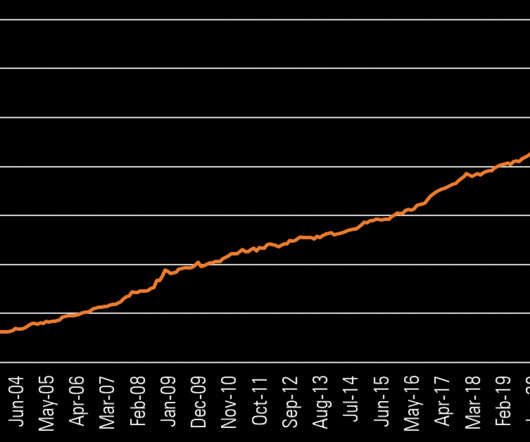

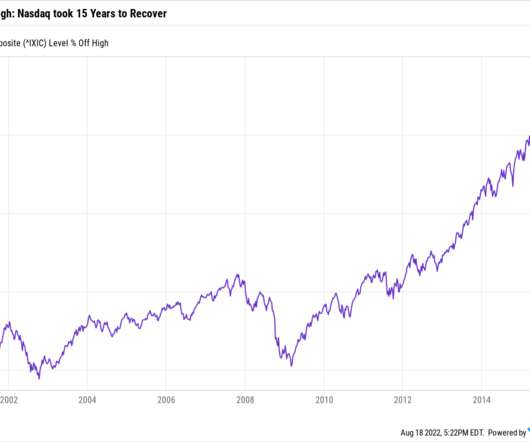

I have addressed Tax Alpha before ( see this and this ); but Pomp indirectly raised a very different issue: Why do people underperform their own assets? That underperformance between asset class returns and investor returns is the behavior gap. The 10-year returns for equities (2012-2021) when the SPX generated 16.6%

Let's personalize your content