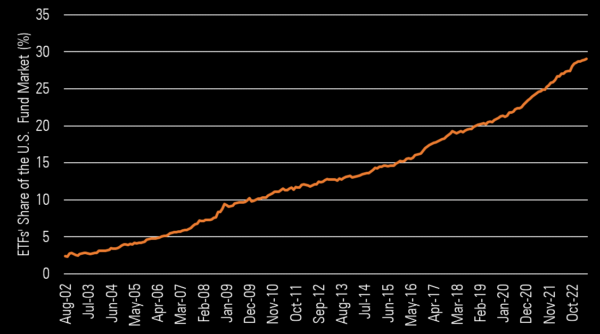

Back in 2012 I wrote a short piece about how the ETF world was in the very early stages of eating up the mutual fund world. At that time the ETF world had just 12% of the share of the fund world’s assets (chart via Ben Johnson). Since then the ETF trend has continued and as of May 2023 the total ETF share is 29%.

It’s also interesting to look at this from the fund number level. According to ICI there are 8,763 mutual funds as of the end of 2022. Meanwhile there are just 2,989 ETFs. This trend is STILL early.

My general view is that most people don’t appreciate the advantages of ETFs and that this process of adoption is taking a long time. For instance, I wrote a detailed piece the other day about how a fund of funds ETF can create a more efficient indexing portfolio without sacrificing liquidity or diversification. But this hyper tax efficient factor in ETFs is still widely misunderstood and underappreciated. I thought I knew a lot about ETFs until I went through the process of launching an ETF, designing one and managing one. And you can’t fully appreciate how the machine operates until you’ve opened the hood, designed the engine, installed it and driven it around. And after having gone through that process I am even more convinced that we’re in the early goings of this trend.

The three big trends that will drive the decline of mutual funds are:

- Conversions

- Retirement space changes

- Advisor adoption

Conversions are the biggie since existing players can just convert existing mutual funds to ETFs as demand grows, but the other big space is the load of assets locked up in mutual funds inside retirement plans, many of which still don’t utilize ETFs. But the one that’s flying under the radar is advisor adoption. We adopted an ETF model because it streamlines our entire business, increases client tax efficiency and gives us more fee flexibility. This is a win-win for everyone involved and will become more and more common at the advisor level as the cost of launching comes down.

These are huge trends at work because ETFs are simply better wrappers. And we are STILL in the early days of this adoption.

* We obviously eat our own cooking here.