The Evolution of Financial Advice

A Wealth of Common Sense

JUNE 20, 2023

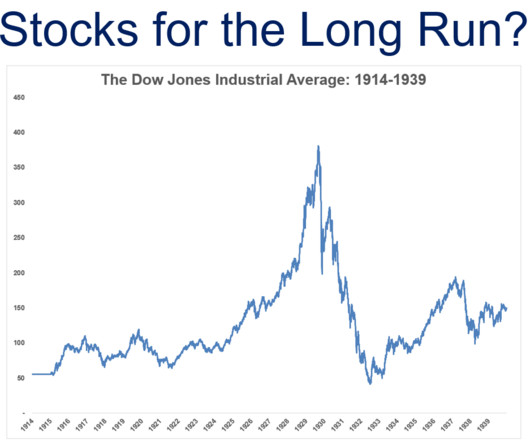

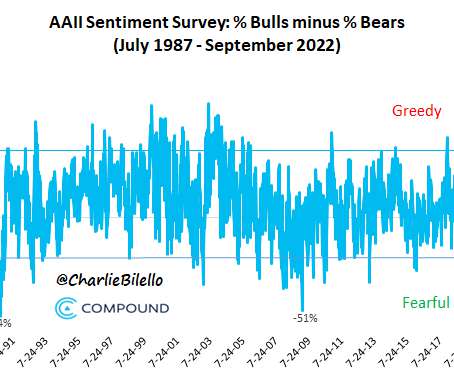

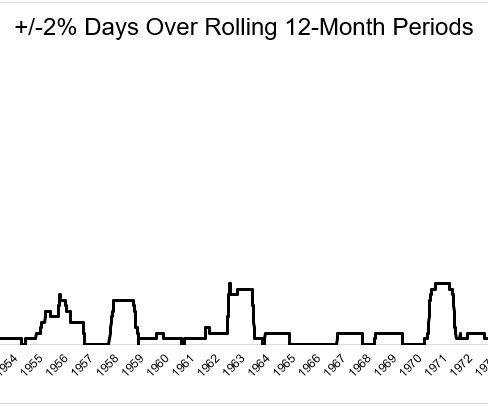

To be a successful investor you need to possess a number of different traits. You need to understand how math, statistics and probabilities work. You need to understand corporations and the global economy generally function over the long haul. You also need a deep understanding of financial market history from booms to.

Let's personalize your content