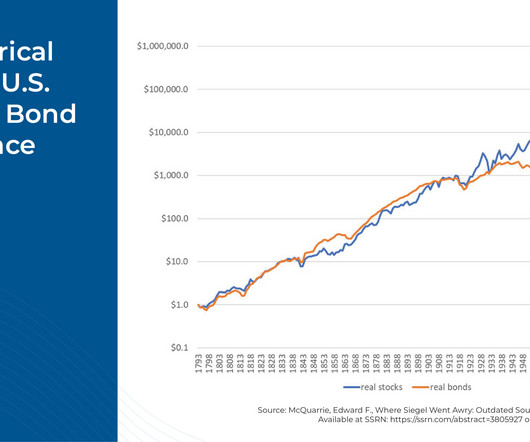

In The Long Run, Stocks Outperform Bonds… Or Do They?

Nerd's Eye View

APRIL 10, 2024

Financial advicers are intimately familiar with the phrase, "Past results are not indicative of future performance." and 26.1%, respectively, historical "tendencies" don't always hold over shorter timeframes, prompting the question: How reliable are our assumptions around the long-term performance of stocks and bonds?

Let's personalize your content