10 Friday AM Reads

The Big Picture

APRIL 7, 2023

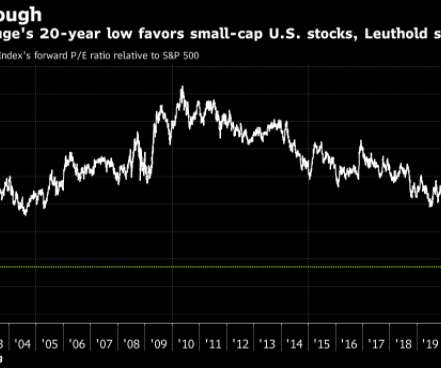

Wall Street Journal ) • How Models Get the Economy Wrong : Seemingly complex and sophisticated econometric modeling often fails to take into account common sense and observable reality. American Prospect ) see also Six Ways Existing Economic Models Are Killing the Economy : The alleged science doesn’t match up to the real world.

Let's personalize your content