Wednesday links: late strategizing

Abnormal Returns

SEPTEMBER 22, 2022

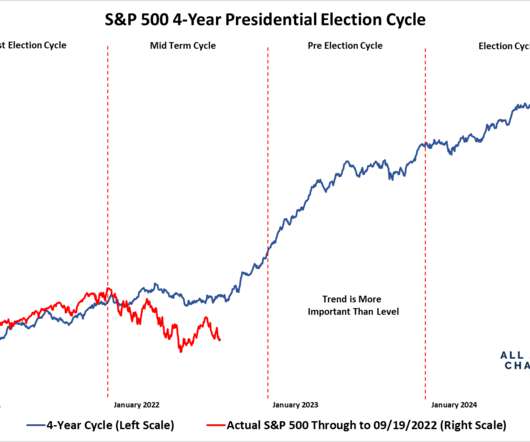

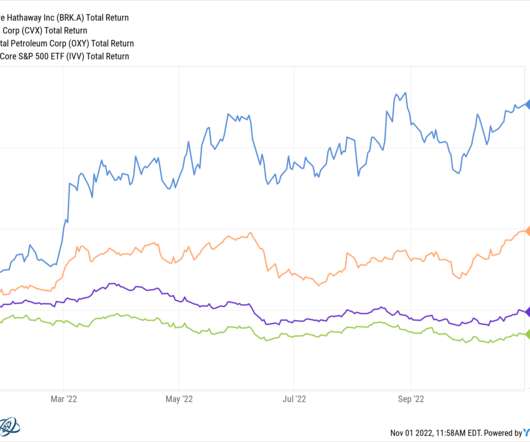

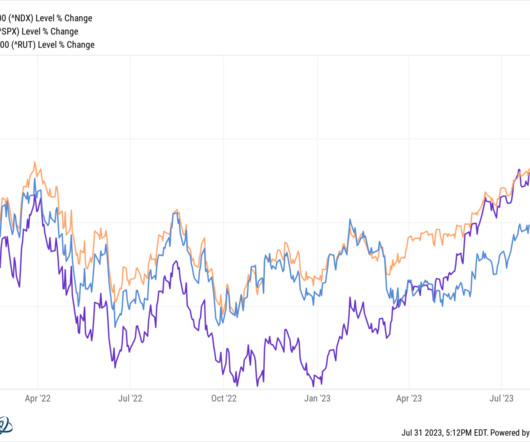

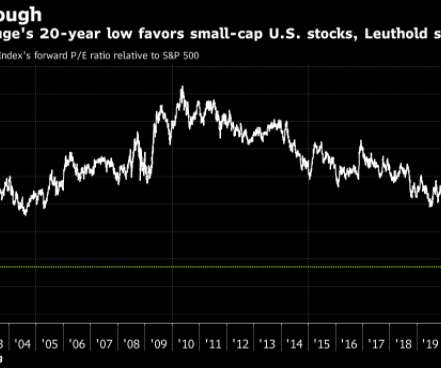

Markets Market valuations are a lot more attractive than they were a year ago. interest rates since 2020. mantaro.money) Media Jeff Jarvis, "If network prime time has lost its value, so have networks, so has television, so has broadcast." (morningstar.com) Breaking down which assets are still ripe for active management.

Let's personalize your content