Top clicks this week on Abnormal Returns

Abnormal Returns

MAY 19, 2024

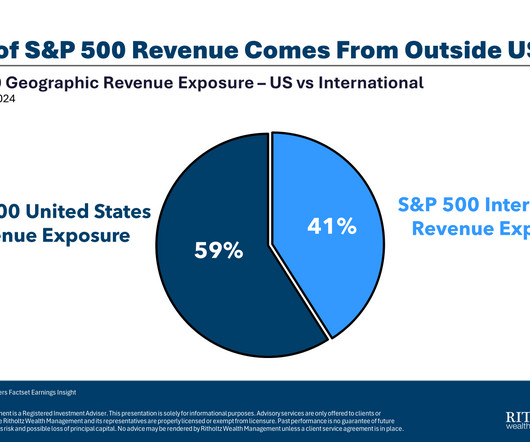

Top clicks this week Three assets that don't diversify your portfolio as well as you think. (morningstar.com) The problematic math of passing down generational wealth. (blogs.cfainstitute.org) International diversification requires a long time horizon. (awealthofcommonsense.com) The S&P 500 is now nearly 40% of global market cap. (apolloacademy.com) Don't confuse selling calls with income.

Let's personalize your content