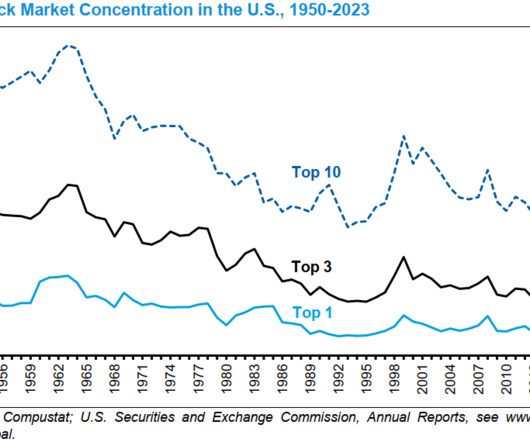

Research links: problematic concentration

Abnormal Returns

JUNE 11, 2024

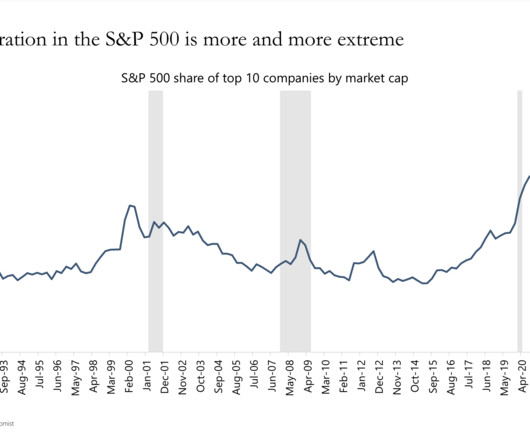

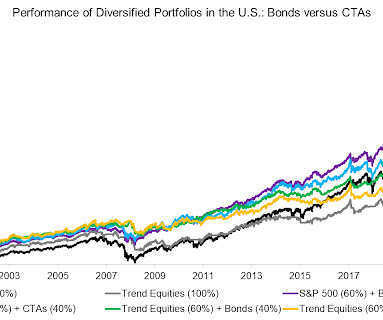

Concentration A look at 200 years of stock market concentration in the U.S. (globalfinancialdata.com) "Stock Market Concentration: How Much is Too Much?" by Mauboussin and Callahan. (morganstanley.com) Trend What happens when you stack managed futures trend on top of equities? (caia.org) Comparing the diversification benefits of bonds vs. trend following.

Let's personalize your content