Permanent Portfolio Review

Dear Mr. Market

OCTOBER 11, 2022

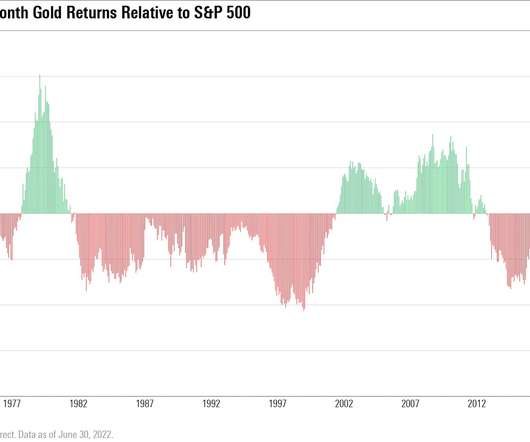

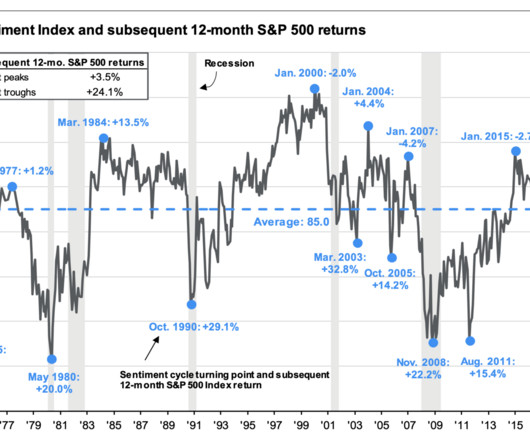

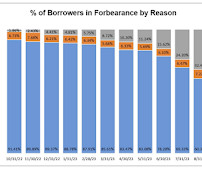

In a year where the stock market has provided zero safe places to hide…you may have changed, the markets certainly have, but one thing has not; the Permanent Portfolio. If you didn’t hit the embedded article links above, the Permanent Portfolio is pretty simple at face value. 25% Cash (economic recession).

Let's personalize your content