Fun With Portfolio Theory

Random Roger's Retirement Planning

JANUARY 14, 2024

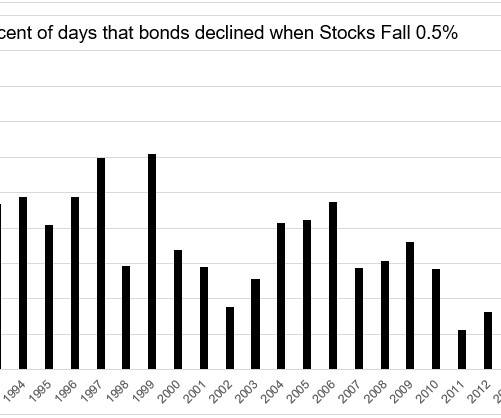

Long time readers might know my fascination with Nassim Taleb's idea about barbelling portfolios to concentrate risk into a small slice while having the vast majority in safe assets. LFMIX in Portfolio 1 is the LoCorr Macro Strategy Fund and in Portfolio 2, QGMIX is AQR Macro Opportunities. So this is interesting.

Let's personalize your content