Fun With Portfolio Theory

Random Roger's Retirement Planning

JANUARY 14, 2024

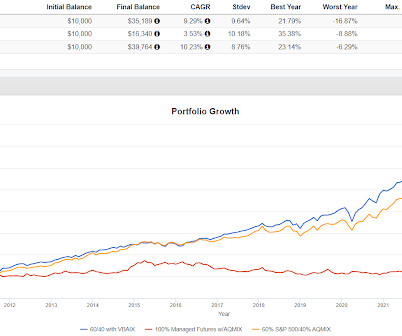

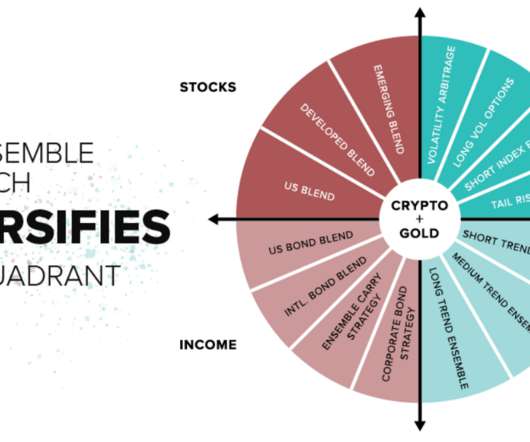

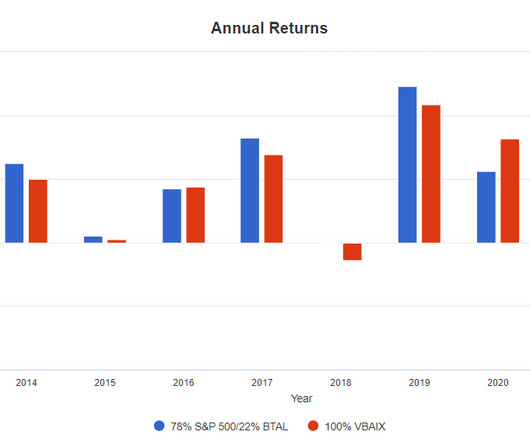

Long time readers might know my fascination with Nassim Taleb's idea about barbelling portfolios to concentrate risk into a small slice while having the vast majority in safe assets. What I am curious to see is if we can combine this barbell idea with the 75/50 portfolio to get a market equaling (or beating) returns over longer periods.

Let's personalize your content