Saturday links: cultivating purpose

Abnormal Returns

MAY 25, 2024

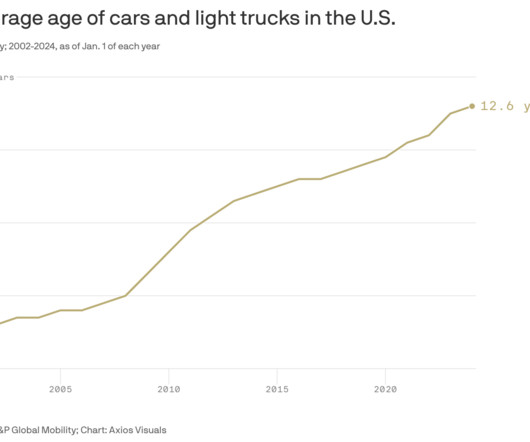

Autos How thieves exploit loopholes to steal keyless cars. (fastcompany.com) This police department has gone electric with Tesla ($TSLA) Model Ys. (thecooldown.com) Your next Airbnb may have a charging station. (fastcompany.com) Used cars The safest used cars for teenagers. (axios.com) How to not get screwed buying a used car. (kottke.org) Roads Congestion pricing is coming to Manhattan.

Let's personalize your content