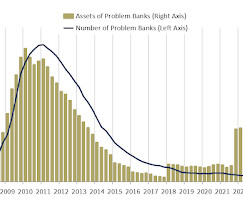

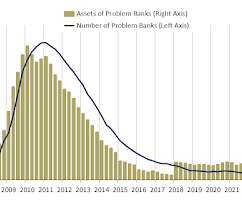

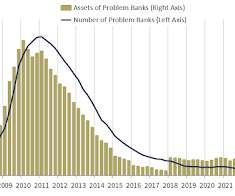

FDIC: Number of Problem Banks Unchanged in Q2 2023

Calculated Risk

SEPTEMBER 7, 2023

Asset Quality Metrics Remained Favorable Despite Modest Deterioration: Loans that were 90 days or more past due or in nonaccrual status (i.e., The FDIC reported the number of problem banks was unchanged at 43. The number of FDIC-insured institutions declined from 4,672 in first quarter to 4,645 this quarter. billion to $46.0

Let's personalize your content