Equity Beat: In Consideration of the Macro

Brown Advisory

APRIL 21, 2023

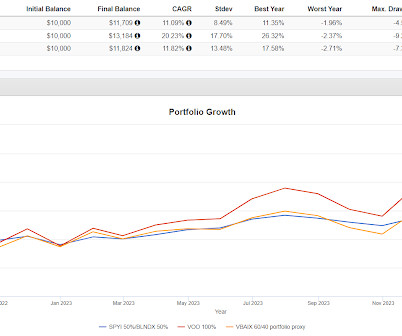

But we never forget that we manage diversified portfolios, and those portfolios are indeed affected by macro factors; inflation, interest rates, bank liquidity and other issues facing the economy will of course influence the prospects of the companies we hold in our strategies. Happily, I can use myself as a handy illustration.

Let's personalize your content