The Benefits & Purpose of a Trust in Estate Planning

Carson Wealth

OCTOBER 25, 2023

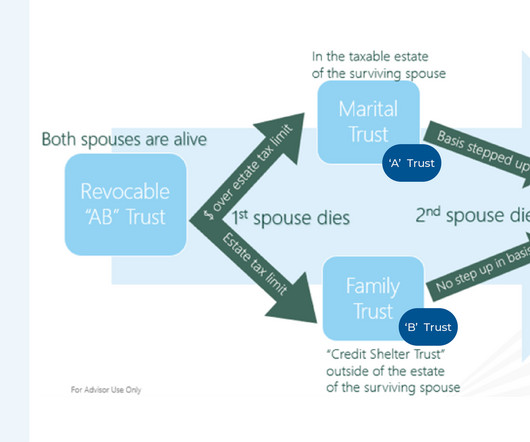

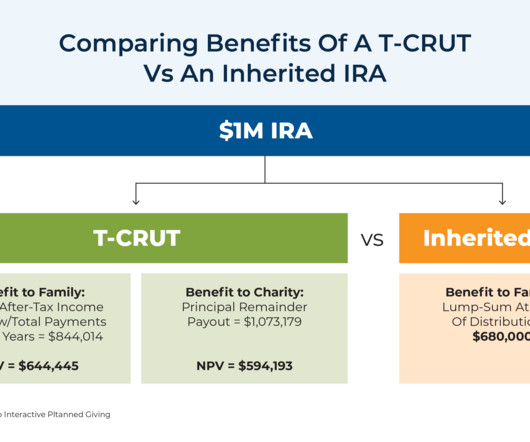

By Beth Schanou, JD, CExP, Senior Wealth Planner Clients frequently ask whether they should leave their assets in a trust. If your net worth plus the death benefit of life insurance policies you own exceeds $13 million, putting your assets in specific types of trusts can be helpful for federal estate tax issues.

Let's personalize your content